Grupo Financiero BBVA México, for the 7th consecutive year, has ranked 1st consecutive year, has ranked

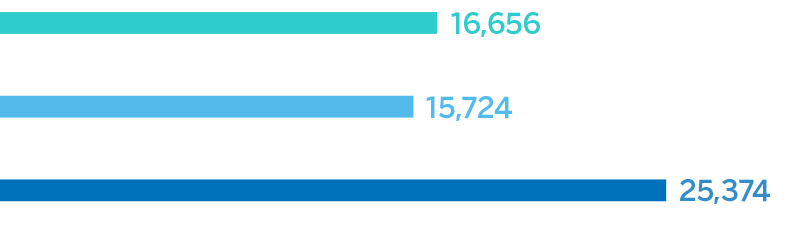

Open Market Recommendation Index

Part of Grupo Financiero BBVA México’s strategy is based on carrying out studies on the perception of the brand in order to optimize attention, products and services for its customers. The result of this entire strategy is reflected in GFBB’s position in the Open Market Recommendation Index.

|

Business or Channels |

Points above the |

|---|---|

|

Commercial Banking |

+ 30 |

|

Government and Commercial Banking |

+ 32 |

|

SME Banking |

+ 3 |

|

Telephone Banking |

+ 12 |

|

Mobile Banking |

+ 28 |

|

ATM’s |

+ 30 |

Internal Customer Recommendation Index

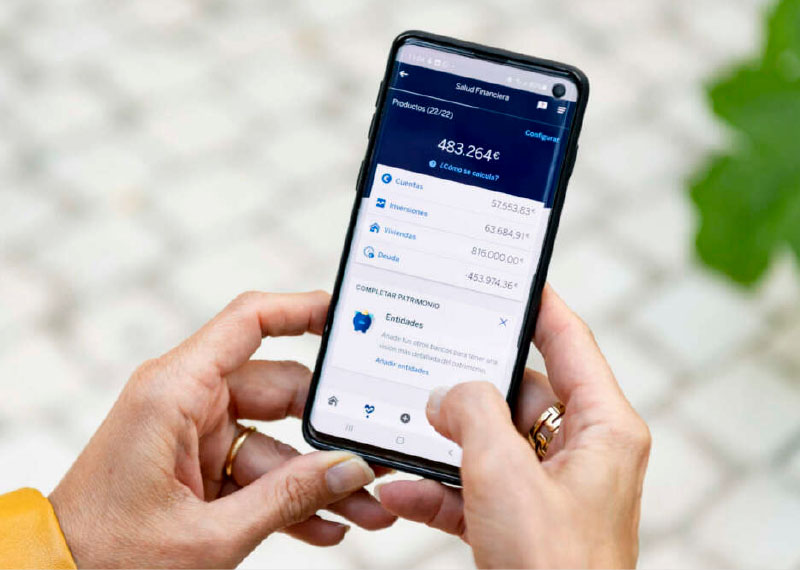

For Grupo Financiero BBVA México, the satisfaction and well-being of its customers is a priority; therefore, to know their perception, surveys are conducted, mainly electronic, both internal and external.

Customer Perception

|

Bank |

2021 vs 2020 Change |

|---|---|

|

Commercial Banking |

9 |

|

Wealth Management and Private Banking |

1 |

|

SME Banking |

20 |

|

Government and Commercial Banking |

2 |

|

Mortgage Banking |

2 |

|

Banca Consumer Finance |

3 |

Perception of the internal employee

|

Bank |

2021 vs 2020 Change |

|---|---|

|

Commercial Banking |

2 |

|

Wealth Management and Private Banking |

3 |

|

SME Banking |

3 |

|

Government and Commercial Banking |

0 |

|

Mortgage Banking |

9 |

|

Banca Consumer Finance |

1 |

Specialized Customer Service Unit (UNE)

For Grupo Financiero BBVA México, customer feedback is essential to improve the services, products and attention provided; therefore, a channel is made available to clarify complaints and claims through: branches, BBVA line and website.

The UNE has the following channels:

Email:

une.mx@bbva.com

Call center in Mexico:

800 112 2610

Call center International:

55 1998 8039

Corporate offices:

Mexico City and Guadalajara

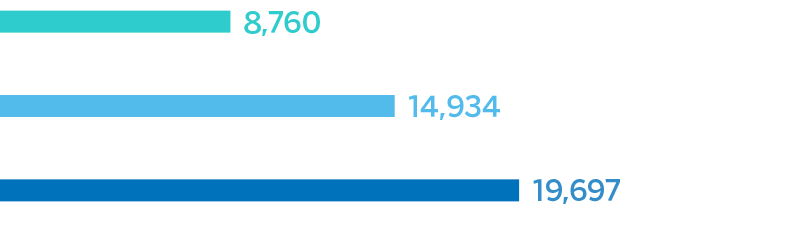

Claims filed with UNE

Claims filed with CONDUSEF