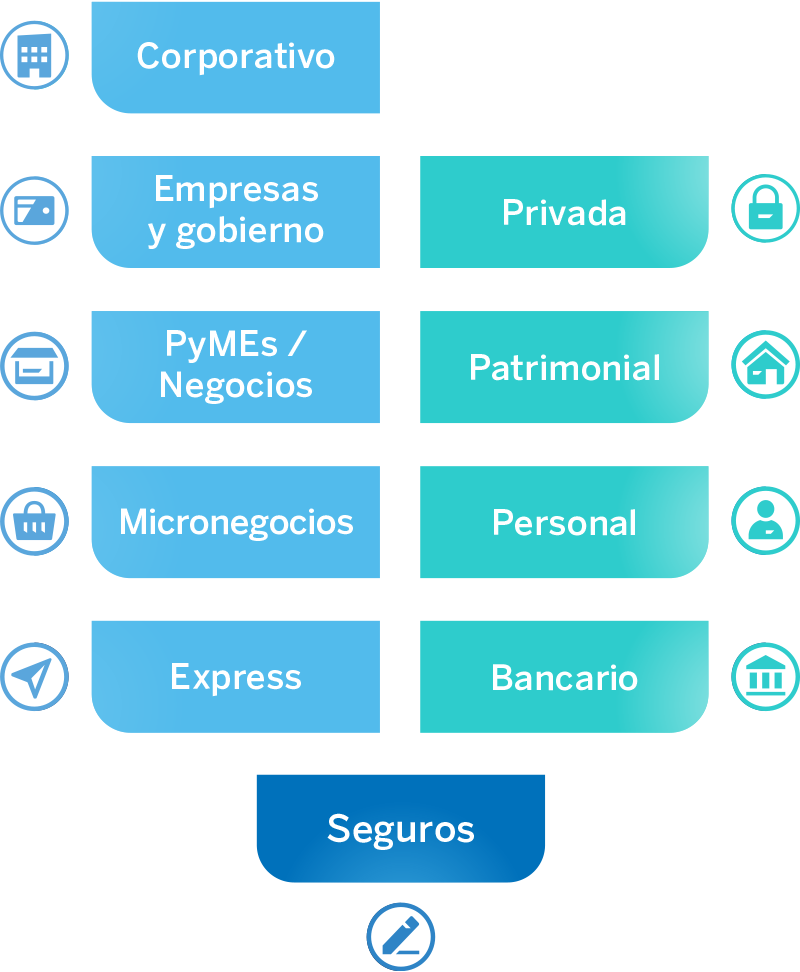

With the aim of increasing cross-selling opportunities, the level of customer loyalty and improving experiences, this unit offers services and specialized attention to customers in the following customer segments:

-

Business Entities: with savings, credit, cash management and collection solutions. Through the BBVA Empresas App, it is possible to manage and administer the business from your cell phone and, in addition, through this medium a wide variety of services and digital offers are offered.

-

Home Developers: offers loans to developers for construction purposes.

-

Consumer Financing: within banking, this specialized unit was created exclusively to meet the diverse requirements of the automotive industry, including loans for the distribution and acquisition of vehicles, and is also part of Corporate and Investment Banking, since it provides services to meet the financial needs of car dealers.

-

Government Entities: Grupo Financiero BBVA México offers specialized and tailored service to meet the needs of the Mexican Federal Government, the States and Municipalities of Mexico and other government agencies. The wide range of products for this segment includes paycheck services for government employees and checking accounts, as well as tax collection and payment services for States and Municipalities through products such as “Multipagos” and “CIE online”.