Corporate governance

The corporate governance system of Grupo Financiero BBVA México is governed by a set of values and principles for the fulfillment of its objectives:

-

Optimum composition of its governing bodies.

-

Clear definition of duties between the Board of Directors, its Committees and Senior Management.

-

Solid decision-making process and consolidated informational model.

-

BBVA Mexico management monitoring, supervision and control system.

The Board of Directors is the body in charge of the management of the GFBB, and its members are appointed by the General Ordinary Shareholders’ Meeting. The Board is responsible for approving goals, guidelines and policies in matters of credit origination and servicing, which must be consistent with, compatible with and complementary to those established for Comprehensive Risk Management. It also appoints the Committees and officers of GFBB responsible for preparing said goals, guidelines and policies. Additionally, the Board knows and, where appropriate, approves, at the proposal of the Audit Committee, the goals of the internal control system and the guidelines for its implementation.

The General Ordinary Shareholders’ Meeting is in charge of evaluating the performance of the Board through approval of the Board’s Annual Report, audited financial statements and ratification of Board members.

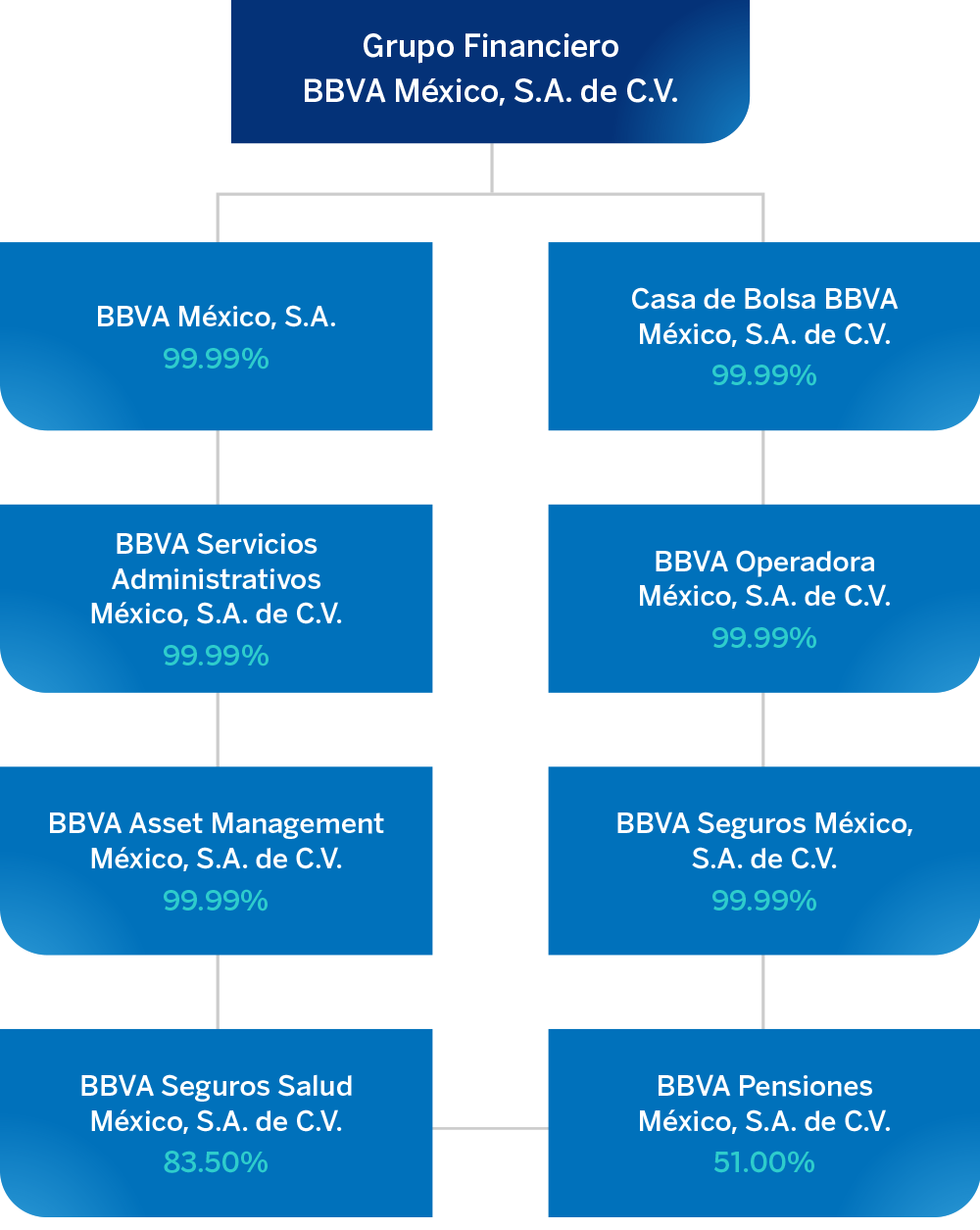

Corporate Structure of Grupo Financiero BBVA México

Structure as of December 31, 2021.