Report from the President

of the Board of Directors

Report

from the President

of the Board

of Directors

In 2021 we continue to develop the sustainability strategy through a new Global Sustainability unit to continue with our 2025 Commitment aligned with the Sustainability Policy and thus strengthen our activities to comply with the global warming scenario of no more than 2°C.

A Global Sustainability unit was created to ensure permeability of sustainability at the highest executive level of the organization.

The creation of innovative solutions to finance the investments of our customers capable of generating positive environmental and social impacts continues to be a fundamental axis of the business model to work together on sustainability.

Sustainability is a strategic priority for BBVA, which is why, by 2025, the figure of EUR 100,000 million in sustainable financing will double. In 2021, Grupo Financiero BBVA México increased sustainable financing by 373% compared to 2020, promoting the issuance of five green bonds and two social bonds issued by the International Capital Market Association and under BBVA’s Sustainable Development Goals (SDGs) Bond Framework.

Similarly, reinforcing Grupo Financiero BBVA México’s commitment to the Principles of Responsible Investment, we have a BBVAESG investment fund which has assets of MXN 549 million.

In November 2021, BBVA announced the objectives for the decarbonization of its loan portfolio in 2030 for industries that are intensive in CO2 emissions. These are intermediate objectives with a view to being neutral in carbon emissions in 2050, this is a global commitment, with Mexico being a fundamental actor.

We were also neutral in direct carbon emissions by offsetting the environmental footprint with carbon dioxide (CO2) mitigating projects, which also generate a positive impact on the local communities where they are developed. These actions, among others, consolidate BBVA Mexico in 2021 as one of the leading banks in Mexico in the region in sustainability matters.

Grupo Financiero BBVA México places the first IDB Invest social bond that promotes gender equality and the amount of the issuance was MXN 2,500 million.

With this transaction, we have promoted gender equity among the highest-ranking positions at GFBB, encouraging greater participation by women. The proceeds obtained from this issuance shall be used to finance projects under the IDB Invest sustainable debt framework, focused on promoting women.

Every day we assume a responsible commitment to our 40,383 employees in every way. During 2021 we have continued to position ourselves as one of the most attractive companies to work for, obtaining various awards. The Wellness program and the “Work Better, Enjoy Life” initiative contribute to strengthening Grupo Financiero BBVA México’s efforts to ensure the health, safety and well-being of our employees.

Grupo Financiero BBVA México ranked third in the “The Most Attractive Employers in Mexico 2021” by Universum and first place in the Employers for Youth survey.

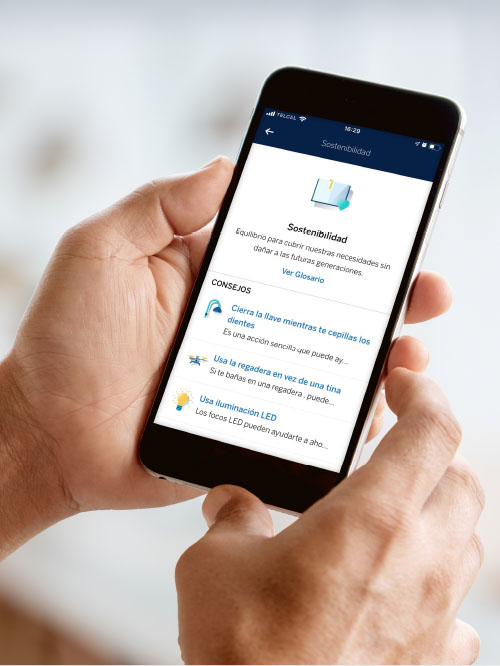

Grupo Financiero BBVA México’s commitment to the community continues to strengthen and impact a greater number of Mexicans year after year thanks to the Financial Education programs and Fundación BBVA initiatives. In 2021, we continue promoting, disseminating and communicating about financial education to Mexican families. Through our remote and online workshops, more than 42,000 individuals benefited.

Financial education workshops positively impacted more than 42 thousand individuals.

Our Fundación BBVA México continues to grow as an important player in education for young people in Mexico. In 2021, 44,498 students benefited under the BBVA program for Young Boys and Girls that Inspire, adapting to current realities, creating the Scholarship programs for Online Education and Kids with disabilities.

The number of direct beneficiaries increased by 9.4% compared to 2020, adding a total of 44,498 students under the BBVA program for Young Boys and Girls that Inspire.

We continue to strive to be recognized as the company that offers the best financial products in the country through a responsible value chain and offering all our customers a unique experience. With respect to innovation and digital transformation, new technologies, such as mobile and big data, have allowed us to offer a personalized value proposition.

During 2021, we are proud to have obtained the following recognitions in customer experience:

-

2021 Bank of the Year in Mexico by The Banker

-

2021 Bank of the Year in Mexico by Latin Finance

-

Mexico’s best supply chain finance providers 2021 by Global Finance

-

Global SME Finance Forum 2021, Honorable Mention at the Global SME Finance Forum

-

Rating of “Excellent” for the Trustee department by S&P Global Ratings

-

IT Masters MAG, BBVA México, Top 25 most innovative Information Technology Masters

-

Recognized with the Gallup Award for "Exceptional Workplace"

-

Universum, Top 3 Most Attractive Employers

-

First place in the financial sector according to the "Employers for Youth" survey

-

Third place in the Ranking of the Most Responsible Companies in Mexico, “Merco, ESG Responsibility”

-

CEMEFI Socially Responsible Company Distinction for 21 consecutive years

-

Mundo Ejecutivo, BBVA México ranks in the Top 50 Most Sustainable Companies

-

Distinction as a Healthy Responsible Company, Workplace Wellness Council Mexico

-

BBVA México, Pensions and Insurance, First place in the Ranking of Corporate Integrity IC 500 Expansión

Since 2004 we have been signatories of the "Global Compact" initiative of the United Nations, which promotes the implementation of ten principles in the areas of human rights, labor, environment and anti-corruption, for which this report represents our Communication on Progress (CoP).

The path of Grupo Financiero BBVA México has been one of great achievements. I invite you to read our report Transiting to a Sustainable Future and to join as agents of change so that together we inspire a better sustainable country.

Sincerely,

Jaime Serra Puche

President of the Board of

Directors of BBVA México