Grupo Financiero BBVA Bancomer (GFBB) is a subsidiary of Banco Bilbao Vizcaya Argentaria, one of the leading financial groups in Europe.

GFBB is a private multi-purpose financial institution established under the laws of Mexico. It provides a wide variety of banking products and services, stock exchange brokerage, insurance, mutual fund management and other financial services.

GFBB’s main subsidiary is BBVA Bancomer, the leading bank in the Mexican financial sector in terms of assets, loan portfolio and deposits.

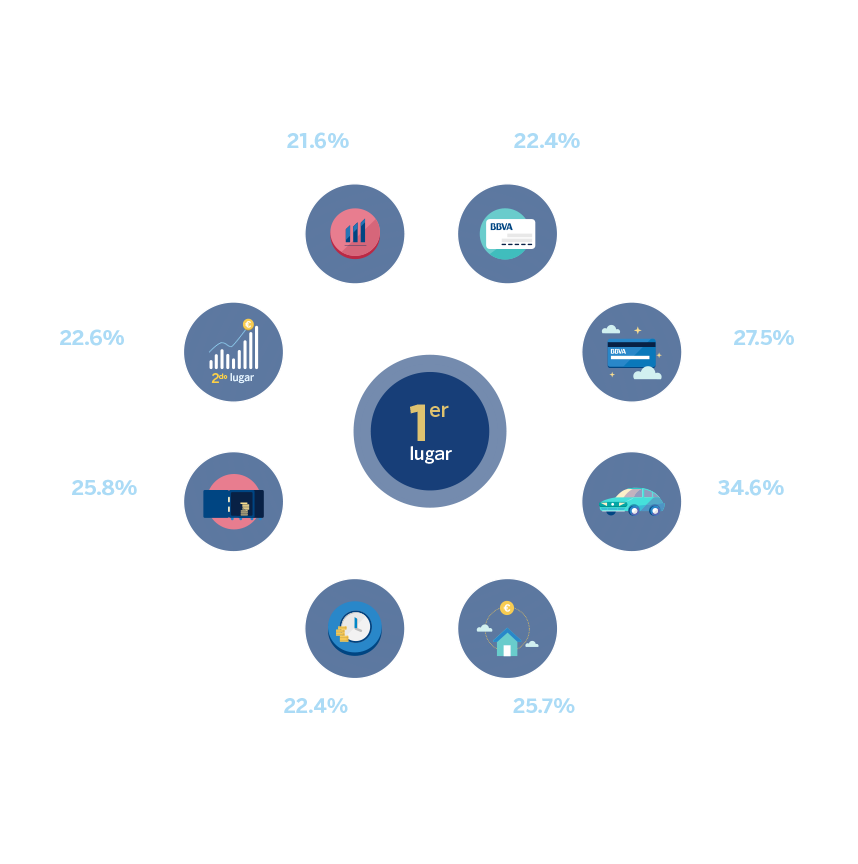

BBVA Bancomer is the leading bank within the Mexican financial system.

BBVA Bancomer operates throughout the Mexican Republic. It serves its customers through an extensive branch network and other distribution channels such as ATMs, banking correspondents, POS terminals, Internet, cell phones, etc. It also has specialized executives who offer outstanding personalized service to individual customers, businesses and government agencies.

BBVA Bancomer, through its Responsible Banking strategy, is playing its part in responding to the sustainability challenges facing the financial sector on a global scale.

Under the six Principles for Responsible Banking1 of the United Nations Environment Programme - Finance Initiative (UNEP/FI), BBVA Bancomer has developed six strategic pillars that will help the Bank plays its role in forging a sustainable future.

1Click here to find out more about the six Principles for Responsible Banking of the UNEP/FI: http://www.unepfi.org/banking/bankingprinciples/

To our customers

To our customers

To our employees

To our employees

To society

To society

Other commitments

Other commitments

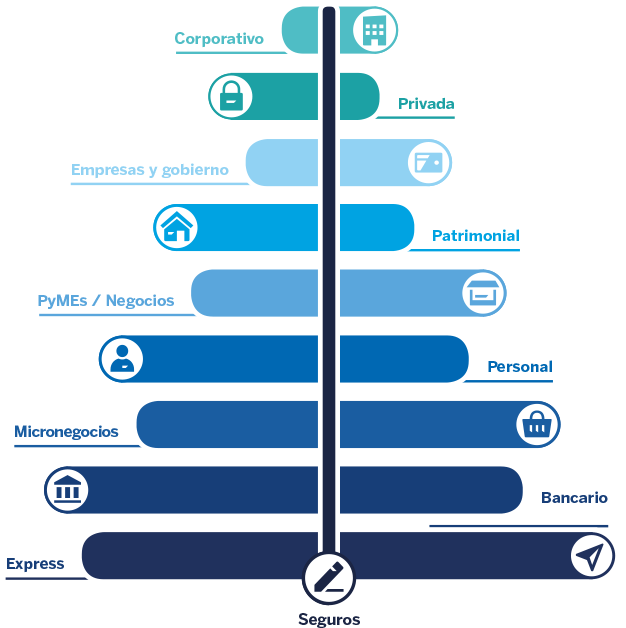

The business model is based on serving each customer segment in a special and customized way, through networks of specialized executives to be able to offer a high quality service. The model is also based on an efficient distribution network with an extensive coverage, which is key for providing easy and secure access to financial services. Lastly, it is a business model that is firmly committed to technology and major investments in transformation and innovation projects.

This model has underpinned the recurrent nature of BBVA Bancomer’s earnings and its strength through outstanding performance characterized by a clear philosophy of risk control with the aim of maintaining long-term profitability.

BBVA Bancomer’s

business model allows

it to create opportunities and

consolidate its leadership in Mexico.

History

History

Leadership

Sources: CNBV, AMIB.

CNBV information: Bank with sofom.

Mutual funds: assets managed at investment firms without duplication.

Information at December 2018.

Presence

| State | Branches | ATMs |

|---|---|---|

| Aguascalientes | 20 | 161 |

| Baja California | 59 | 424 |

| Baja California Sur | 21 | 138 |

| Campeche | 13 | 113 |

| Chiapas | 36 | 252 |

| Chihuahua | 63 | 443 |

| Mexico City | 286 | 2,027 |

| Coahuila | 39 | 359 |

| Colima | 13 | 74 |

| Durango | 20 | 145 |

| State of Mexico | 178 | 1,382 |

| Guanajuato | 85 | 495 |

| Guerrero | 36 | 208 |

| Hidalgo | 34 | 245 |

| Jalisco | 196 | 1,062 |

| Michoacán | 87 | 475 |

| Morelos | 29 | 182 |

| Nayarit | 22 | 140 |

| Nuevo León | 101 | 641 |

| Oaxaca | 25 | 192 |

| Puebla | 67 | 440 |

| Querétaro | 31 | 248 |

| Quintana Roo | 26 | 249 |

| San Luis Potosí | 32 | 190 |

| Sinaloa | 39 | 258 |

| Sonora | 51 | 380 |

| Tabasco | 33 | 227 |

| Tamaulipas | 47 | 344 |

| Tlaxcala | 11 | 87 |

| Veracruz | 83 | 589 |

| Yucatán | 27 | 117 |

| Zacatecas | 23 | 130 |