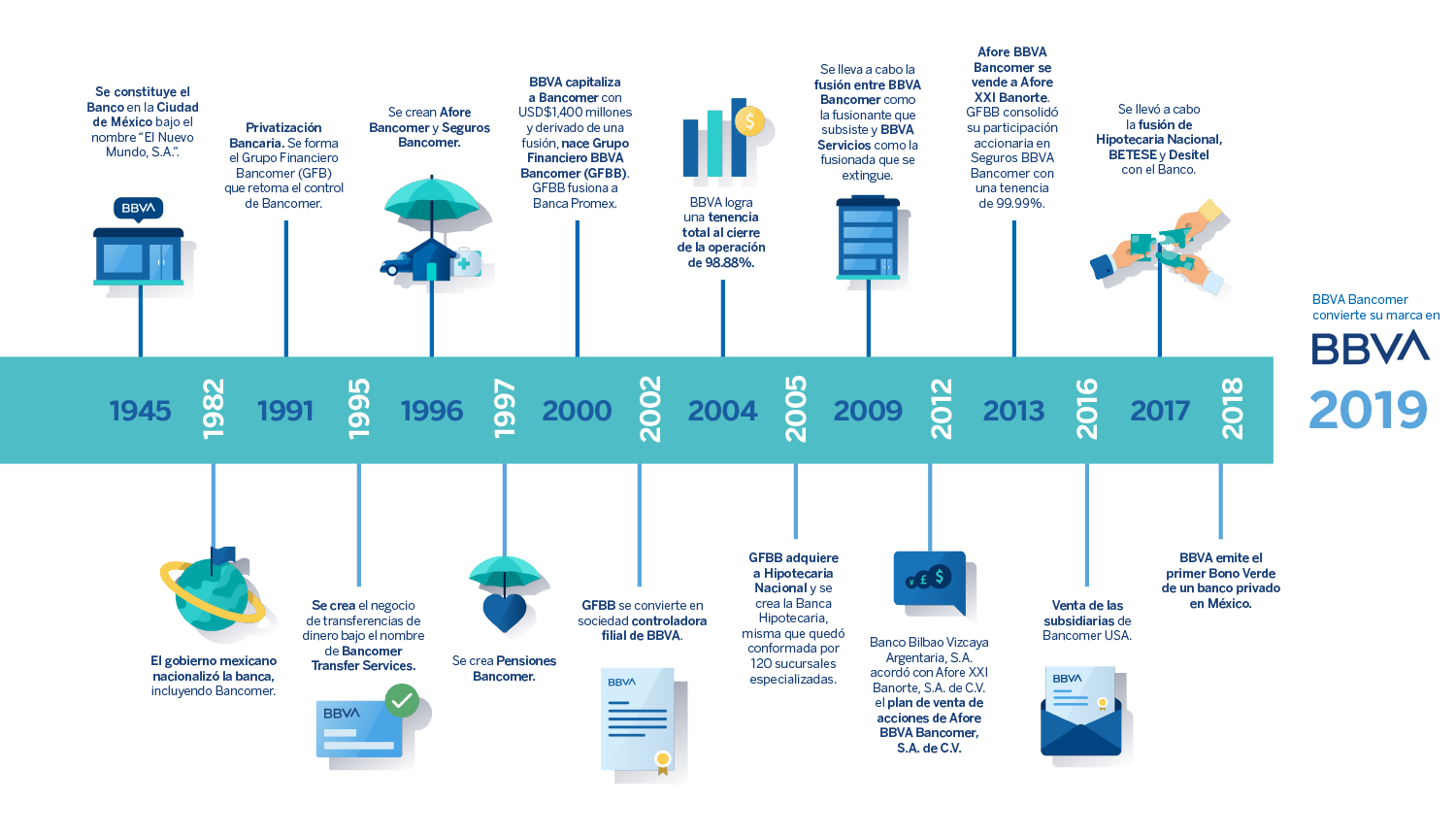

The BBVA Mexico Group is a controlling company authorized to establish and operate as a subsidiary financial group of Banco Bilbao Vizcaya Argentaria, a leading Spanish bank in Europe.

The BBVA Mexico Group consists of different financial institutions, through which it provides a wide variety of banking products and services, stock market brokerage, insurance, investment fund management, as well as other financial services.

Our Aspiration

Building stronger customer relationships...

Redefining our value proposition focused on our customers' real needs.

Our purpose

"To bring the age of opportunity to everyone".

Our Values

The Institution's values are reflected in the day-to-day life of all BBVA Mexico Group employees, influencing all its decisions.

|

Customer comes first

|

|

We think big

|

|

We are one team

|

Strategic Priorities

Starting with the constant transformation of the BBVA Mexico Group to adapt to the major trends of the financial industry (such as the competitive environment, customer behavior and expectations, the pursuit of sustainability and data protection) it has developed three new blocks and six strategic priorities:

|

What defines us

|

|

Levers for outstanding performance

|

|

Catalysts for achieving our goals

|

Strategic pillars of Responsible Banking at the BBVA Group

The BBVA Mexico Group's Responsible Banking model applies to all business and support areas at the Institution, with the aim of seeking profitability that adjusts to our principles, strict compliance with the law, good practices and the creation of long-term value for all stakeholders. The model has four strategic pillars:

|

|

|

|

|

|

|

|

Business Model

BBVA Mexico is a world-class group offering a wide range of services ranging from simple loans to international structured products.

Group BBVA Mexico’s main subsidiary is the bank (BBVA Mexico), a multiple banking institution serving customers in a distinct manner through specialized products and services. The Bank is aware that much of its success as a financial institution is a product of customer satisfaction. That is why it is constantly changing in order to be able to offer the best banking services in Mexico and maintain a long-term relationship with customers.

The business model is based on serving each customer segment in a special and customized way, through networks of specialized executives that allow us to offer a high quality service.

The model is also based on an efficient distribution network with an extensive coverage, which is key for providing easy and secure access to financial services. Lastly, it is a business model that is firmly committed to major investments in technology and in transformation and innovation projects.

Group BBVA Mexico’s business models allows it to create opportunities and consolidate its leadership in Mexico.

This model has underpinned the recurrent nature of BBVA Mexico's earnings and its strength through outstanding performance characterized by a clear philosophy of risk control with the aim of maintaining long-term profitability.

As a result, BBVA Mexico has consolidated its leadership in the country and is in an ideal position for future growth.

Business Units

BBVA Mexico is a bank in constant transformation, evolving every day to improve customer experience, the offer of traditional products and innovating through its digital offering. One of the main elements of the business model is customer segmentation, which allows the Group to provide specialized attention through each of the Business Units dedicated to the development of products and services focused on clients' needs. This, accompanied by the Support Units, which assist the businesses and all networks to generate the best experience for clients and that, in addition, aim to maintain the right recurrence in the business and integral management with synergies that allow continuous growth.

The Commercial Network serves all retail segments through the extensive infrastructure network. Furthermore, it works in conjunction with the Business Development area, responsible for the design of the business strategy, product development and implementation of the entire digital offering, thus complementing the product offering throughout the Network, inside and outside the branches, to enhance the added value offered to clients. In this sense, significant investments have been made to increase cross-selling opportunities while increasing the loyalty of our clients. This has been reflected in the number of customers using digital channels over the past year increasing by 41%, coming to more than 10.1 million clients by December 31, 2019.

At a cross-cutting level, the insurance business drives the product offering throughout the Network, complementing the entire circuit and allowing BBVA Mexico to remain at the forefront as the reference bank in the sector.

This Unit, through a network of 135 branches, serves medium-sized enterprises, government entities, housing developers and distributors in the automotive sector.

BBVA Mexico offers a wide range of products tailored to meet the needs of corporate clients in terms of cash management and collection solutions. As part of segment and by using an integrated vision, the Strategy and Solutions unit is responsible for defining and designing across-cutting products and services offering.

On the Government side, this unit has specialized offices to serve the Federal Government, States and Municipalities of Mexico and all government entities.

Corporate and Investment Banking (CIB) is a transversal business unit that brings together the wholesale businesses. This unit serves global customers such as institutional and large corporate investors, offering them a wide range of investment products. This unit also compasses the Global Markets division, which, together with the Stock Exchange, offers more sophisticated products to individuals and companies. For corporate and institutional clients, BBVA Mexico offers, among others: loan products and services, mergers and acquisitions, market transactions (shares and fixed income), cash management, custody, electronic banking and a wide range of investment products.

Staff Units

To ensure the positive performance of all Business Units, continuous support is received from the Support Units, which, through their advice and consultancy, maintain the proper recurrence of the business and generate the necessary synergies to drive continuous growth.

The Support Units at the Institution include:

Economic Impact

Analysis and Discussion of Results

Commercial Activity Evolution

+6.6%

(billion pesos and annual change %)

MXN 1,218.088 billion in performing loans portfolio, up by 6.6% compared to 2018.

The 2019 results allowed BBVA Mexico to consolidate its position

as a market leader, with a 23%

share at year-end.

BBVA Mexico is

the bank that has seen the largest increase in its loan portfolio balance over the past twelve months, according to information published by the CNBV.

+3.9%

(billion pesos and annual change %)

+9.9%

(billion pesos and annual change %)

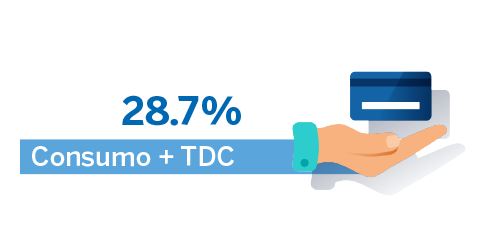

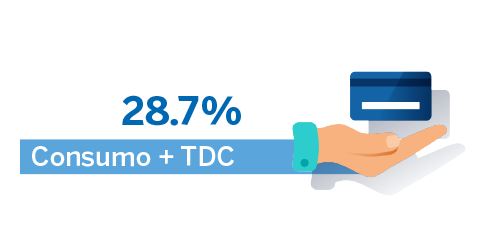

The consumer and credit card loan portfolio totaled MXN 302.366 billion, up by 9.9% year-on-year.

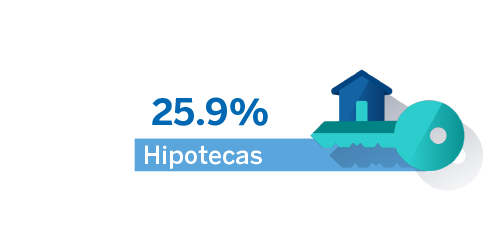

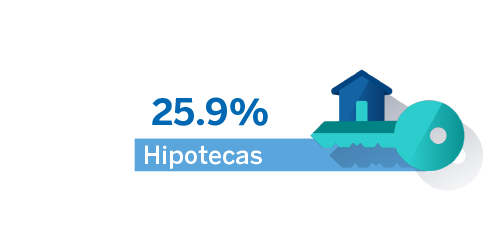

10.9% growth in mortgage loans, to MXN 231.213 billion.

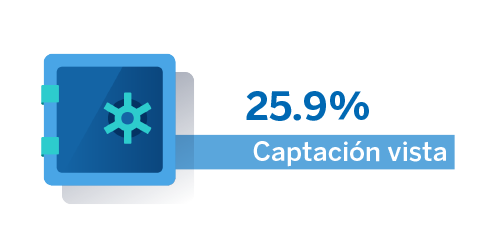

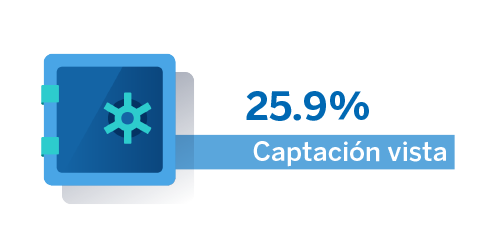

5.5% increase in traditional deposits, to MXN 1,262.023 billion.

+6.7%

(billion pesos and annual change %)

6.7% growth bank deposits (demand and time deposits) at the end of 2019.

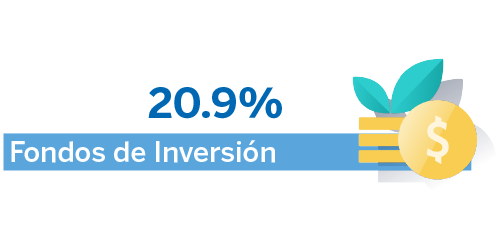

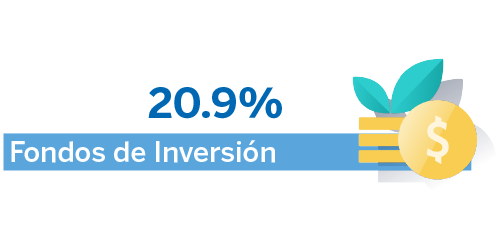

MXN 466.673 billion in assets managed in mutual funds, an increase of 16.6% year-on-year.

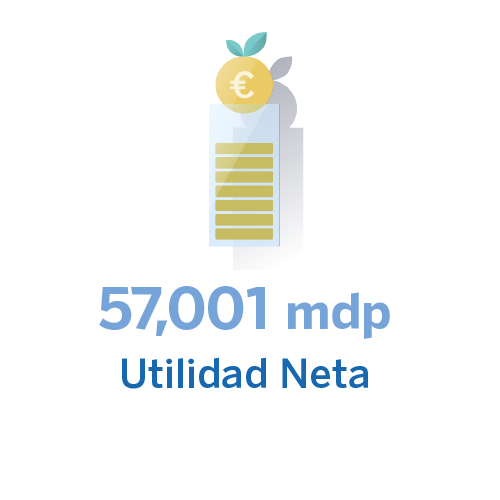

Earnings

+3.4%

(billion pesos and annual change %)

3.4% increase in financial margin at the end of 2019.

+8.3%

(billion pesos and annual change %)

MXN 57.001 billion in net income, up by

8.3% year-on-year.

| Ratios (%) | GFBB | Market* |

|---|---|---|

| Return on equity (ROE) | 25.0 | 16.2 |

| Net Interest Margin (NIM) | 5.9 | 5.0 |

| Cost-to-income ratio | 36.3 | 48.4 |

| NPL Ratio | 2.2 | 2.1 |

*Market made up of 5 Groups at December 2019 (Citibanamex, Santander, Banorte, HSBC and Scotiabank).

Source: Financial Groups Quarterly Report.

BBVA Mexico

December 2019

Leader in infrastructure

| 14.4% | |

|

Branches |

| 23.3% | |

|

ATMs |

| 35.1% | |

|

POS terminals |

Leader in commercial activity

BBVA's contribution to the Sustainable Development Goals

Faced with rising temperatures on our planet, the scarcity of resources, social problems and the growing quest for a sustainable future for everybody, BBVA Mexico Group has been unwavering in its commitment having joined the United Nations Global Compact since 2004.

In 2018, the BBVA Group announced its climate change and sustainable development strategy with a view to contributing to the SDGs and the Paris Agreement. This strategy focuses on the mobilization of capital aimed at curbing climate change and contributing to the specific goals of the SDGs. To mitigate and eradicate the different problems identified as part of each Sustainable Development Goal (SDG) and based on the 2019 materiality study, the BBVA Mexico Group has identified the most important SDGs for the institution along with its level of contribution to achieving these goals. The percentages shown below correspond to the contribution made by BBVA Mexico Group to the specific goals for the implementation of each SDG:

The Sustainable Development Goals were established to address the universal challenges facing humanity, to protect the environment and to overcome social and economic problems. The SDGs comprise 17 goals and 169 specific targets to be met before the end of the 2030 agenda.

To learn more, visit the official website:

https://www.un.org/sustainabledevelopment/es/objetivos-de-desarrollo-sostenible/.

Responsible Banking

|

No poverty |

|

Quality education |

|

Peace and justice strong institutions |

|

Gender equality |

|

Decent Work and Economic Growth |

|

Reduced inequality |

|

Good health and well-being |

|

Industry, Innovation and Infrastructure |

|

Sustainable cities and communities |

|

Responsible consumption and production |

|

Climate action |

No.1 as the most recommended bank by customers

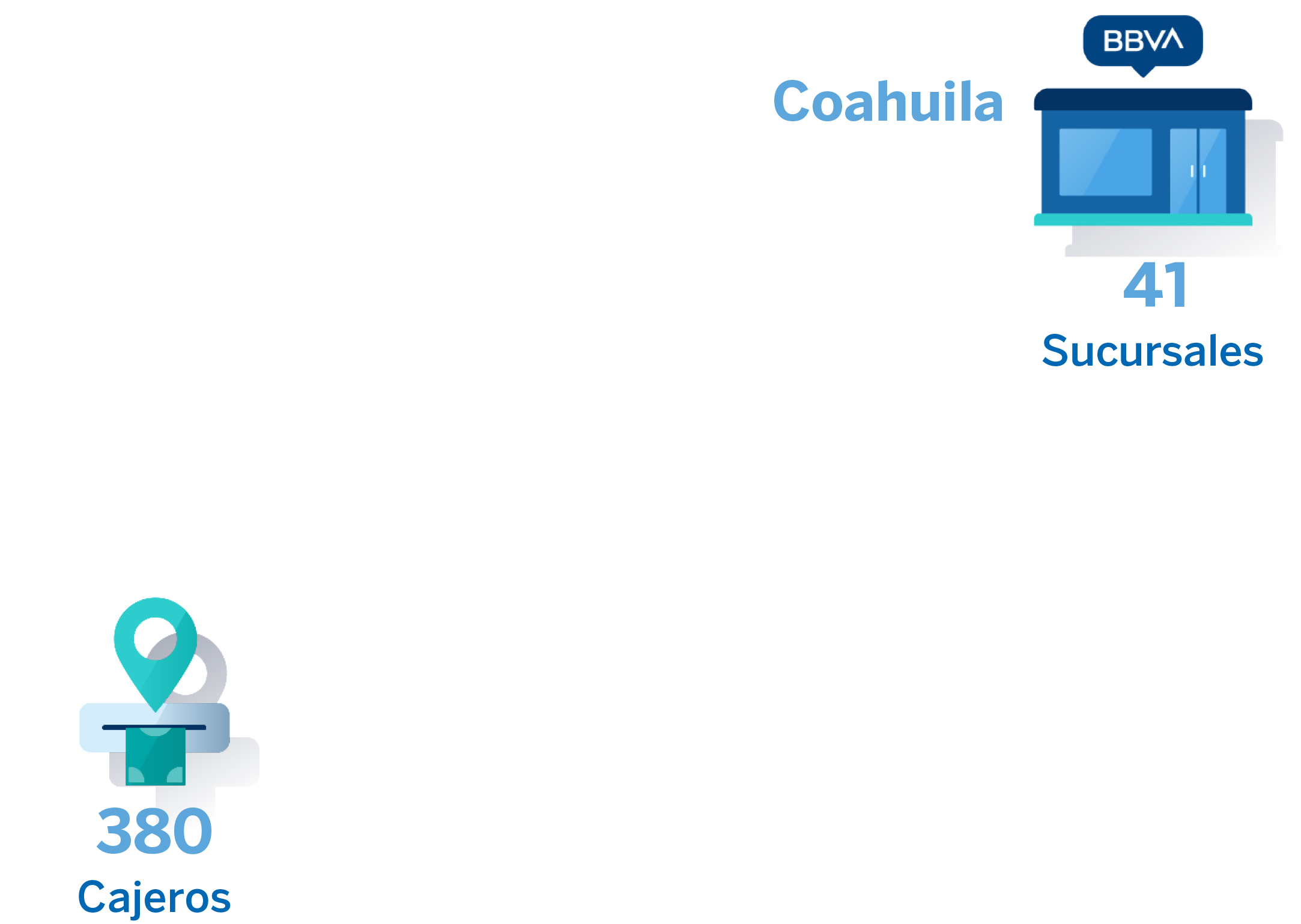

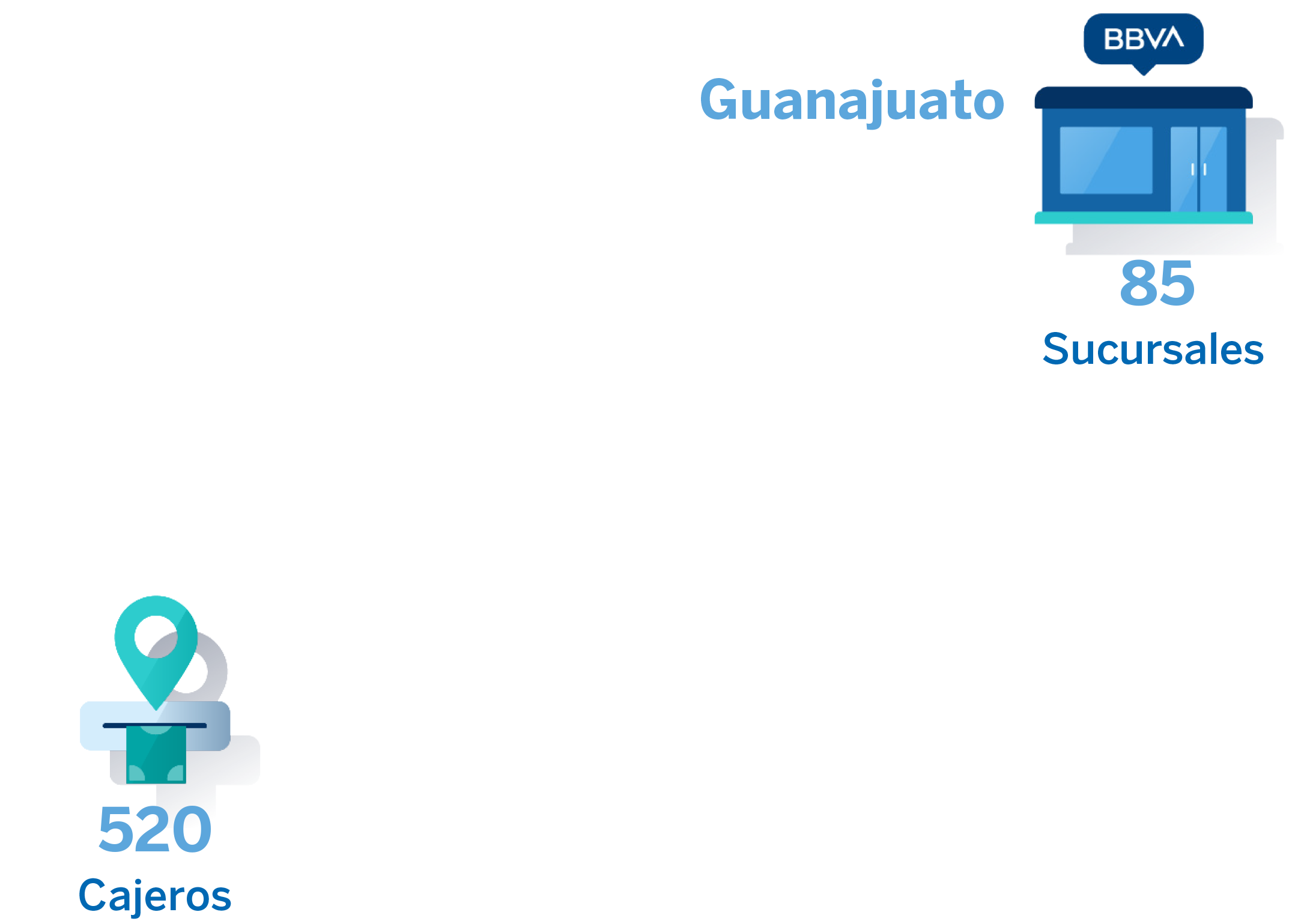

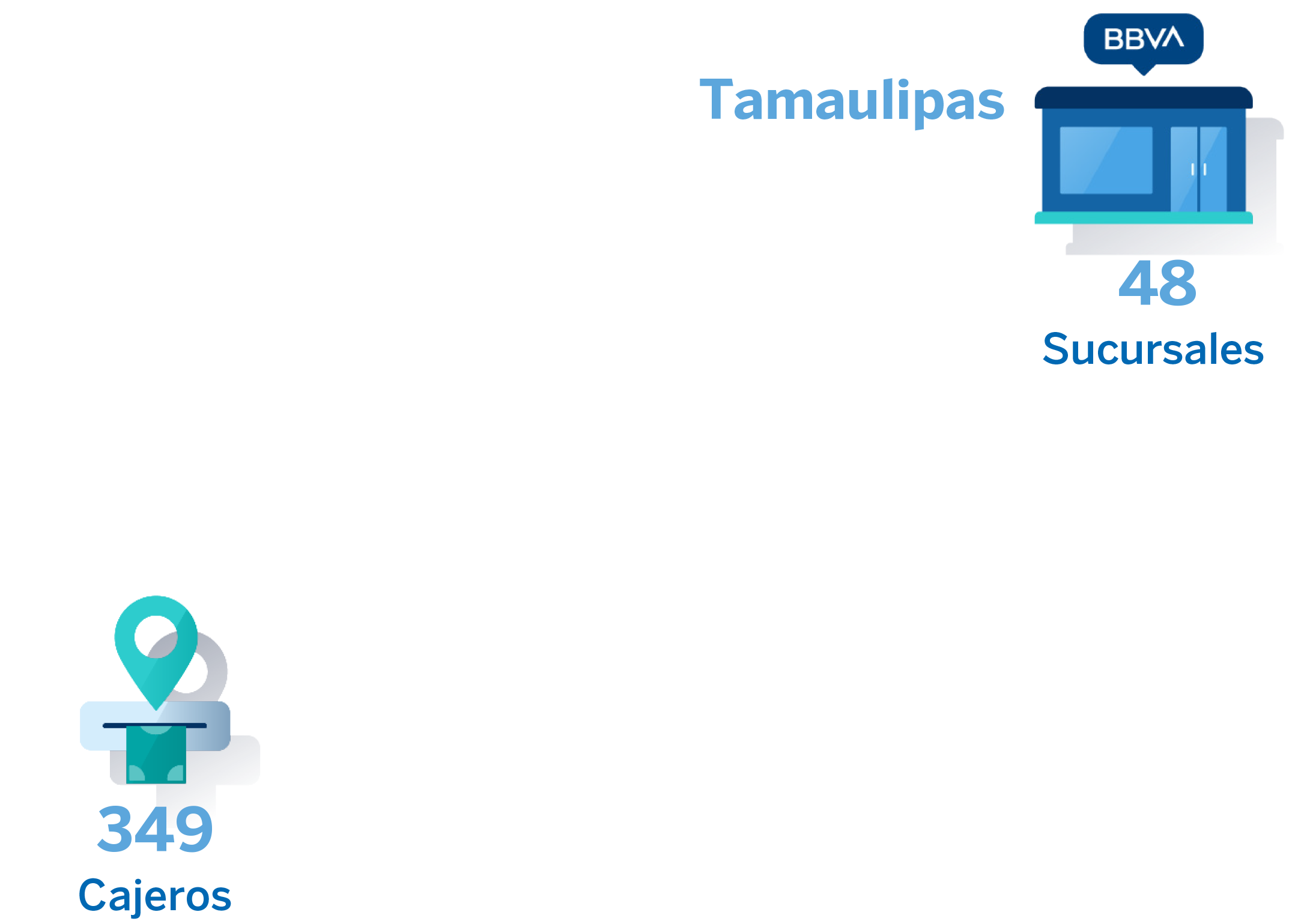

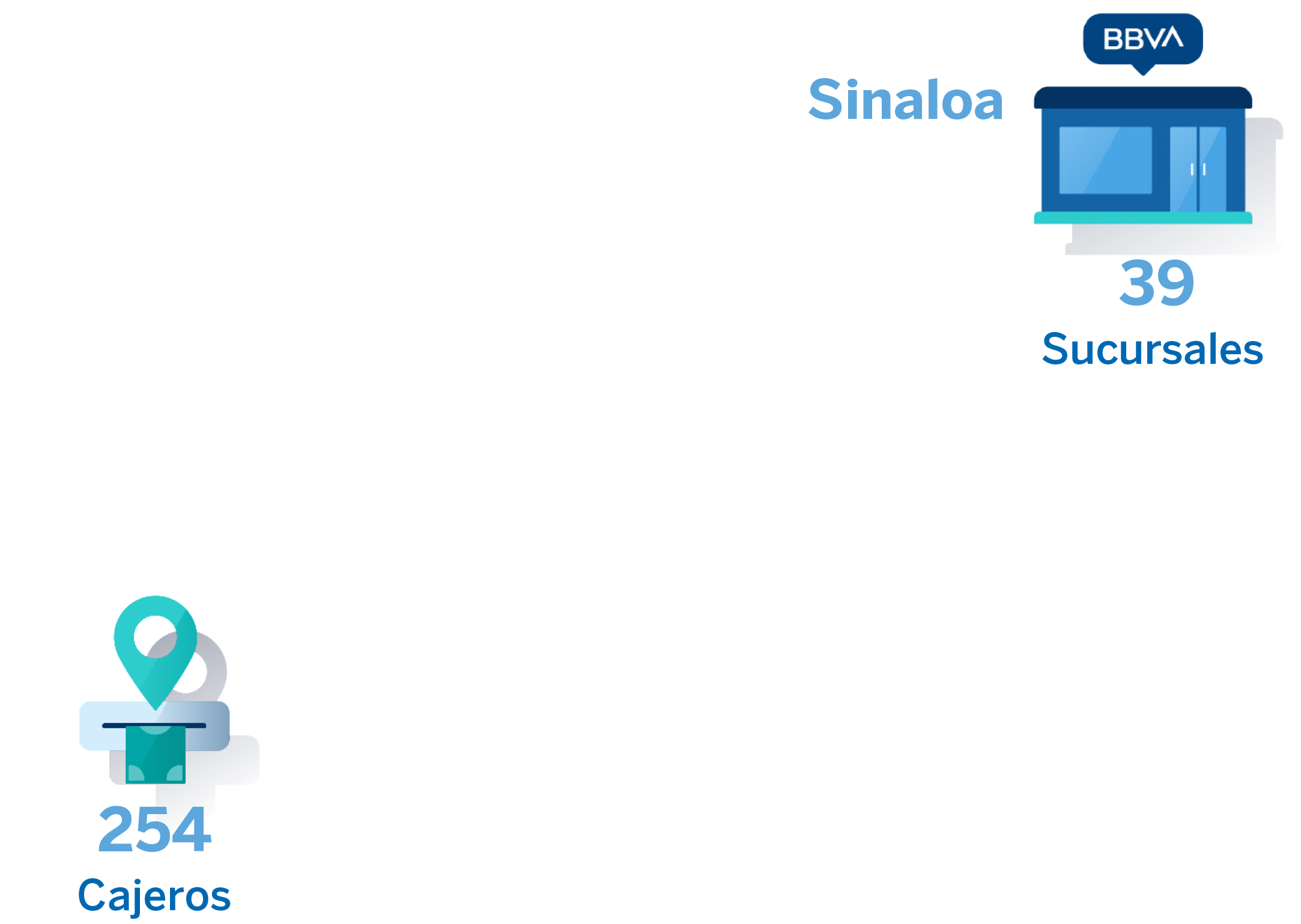

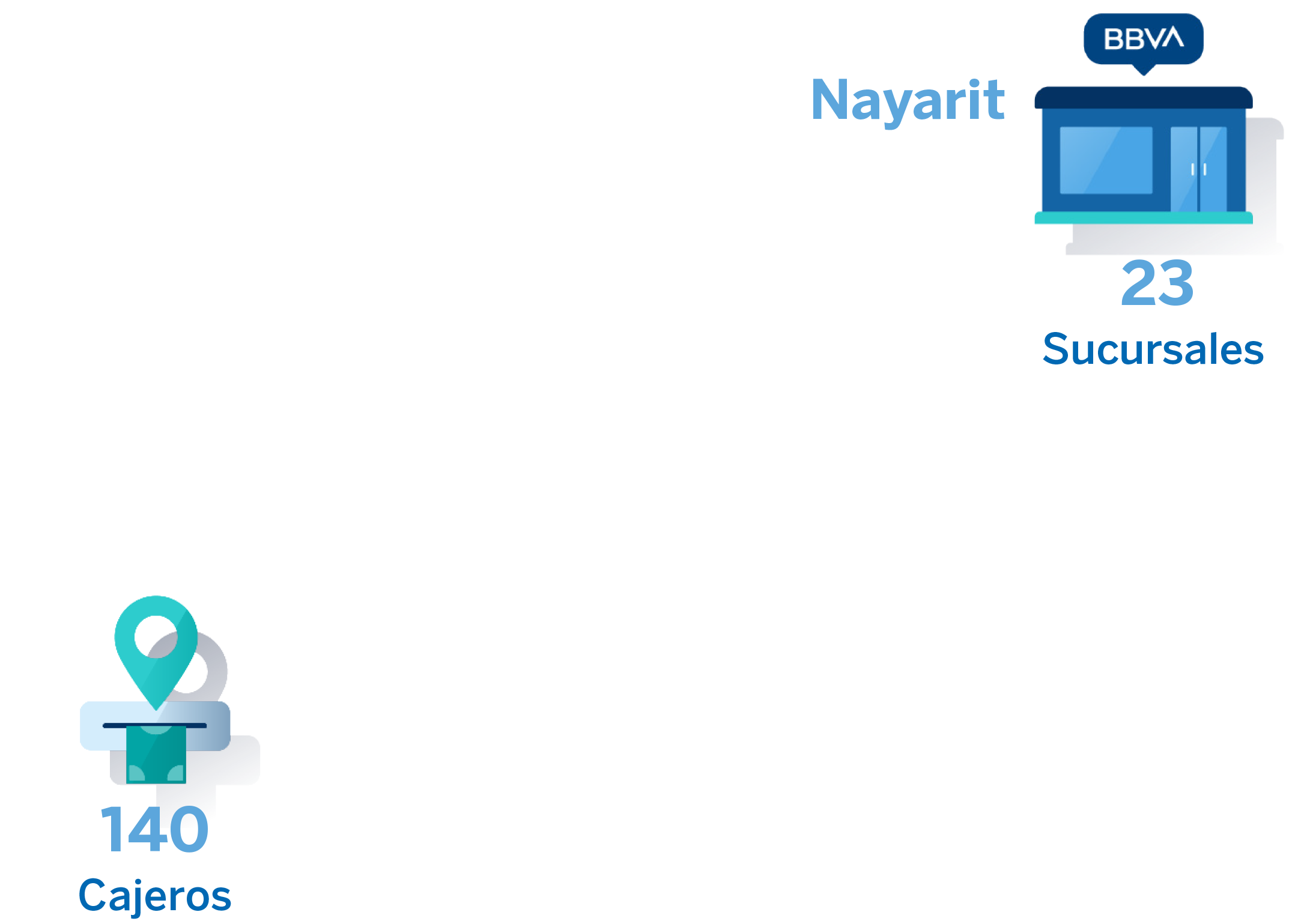

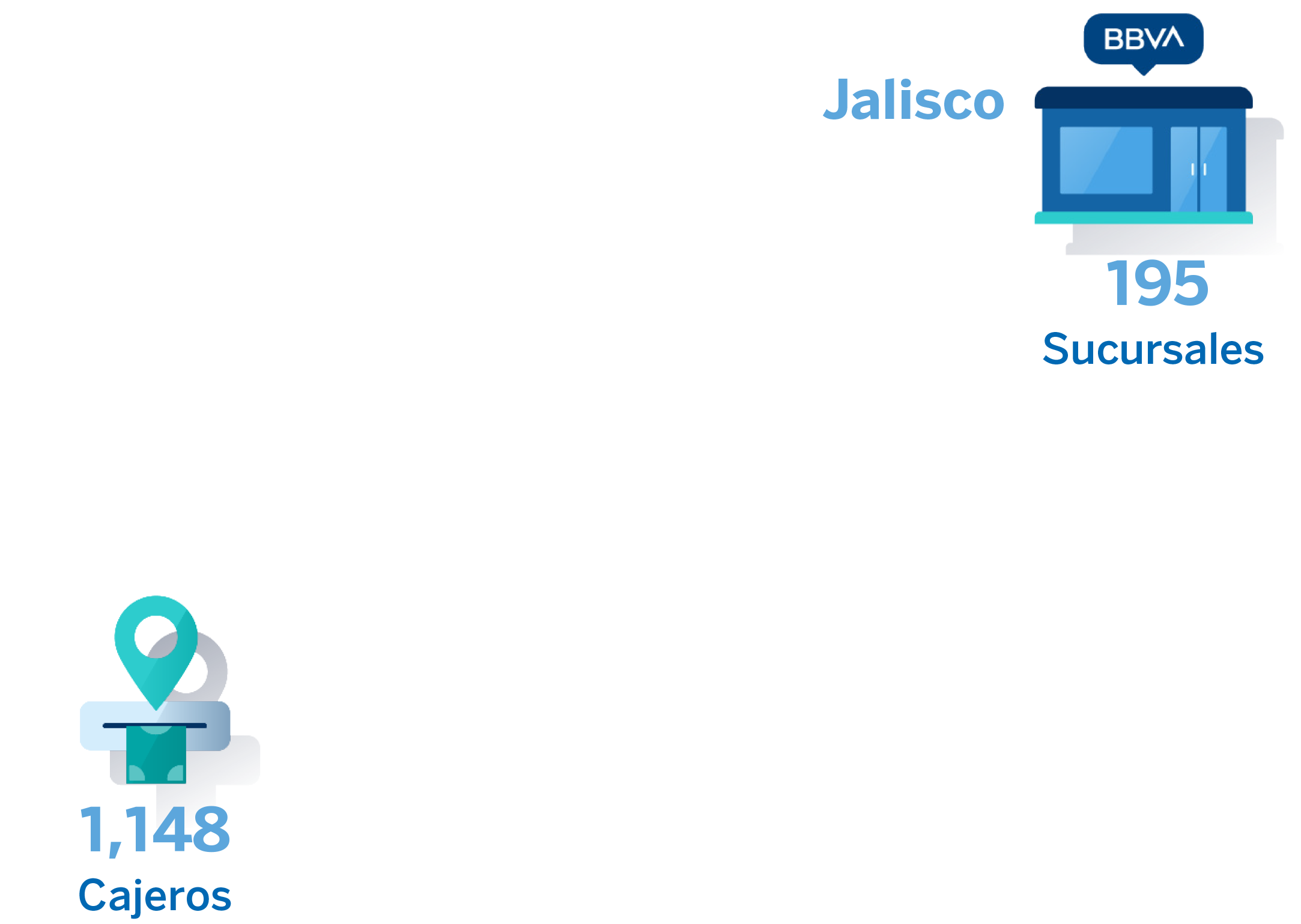

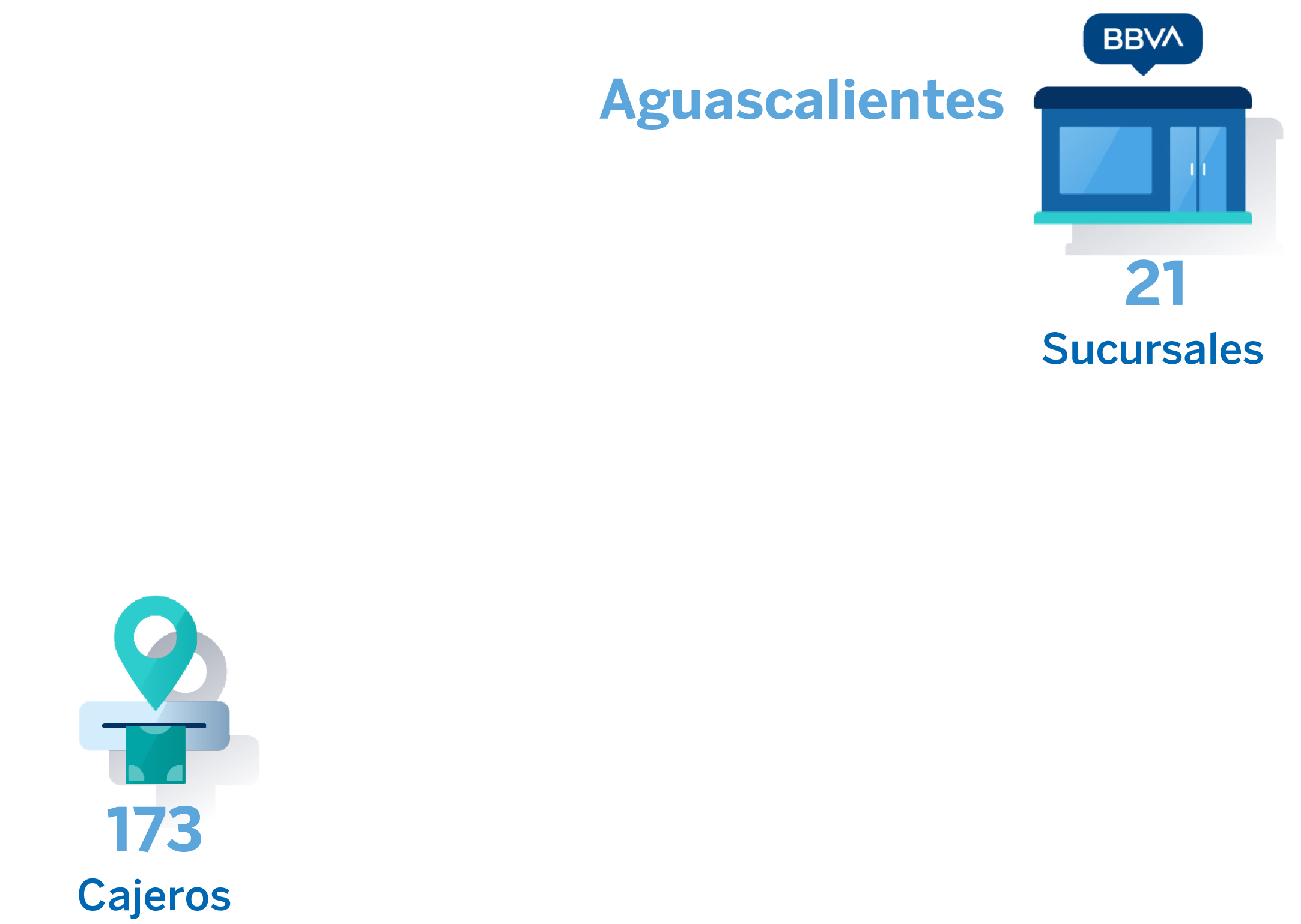

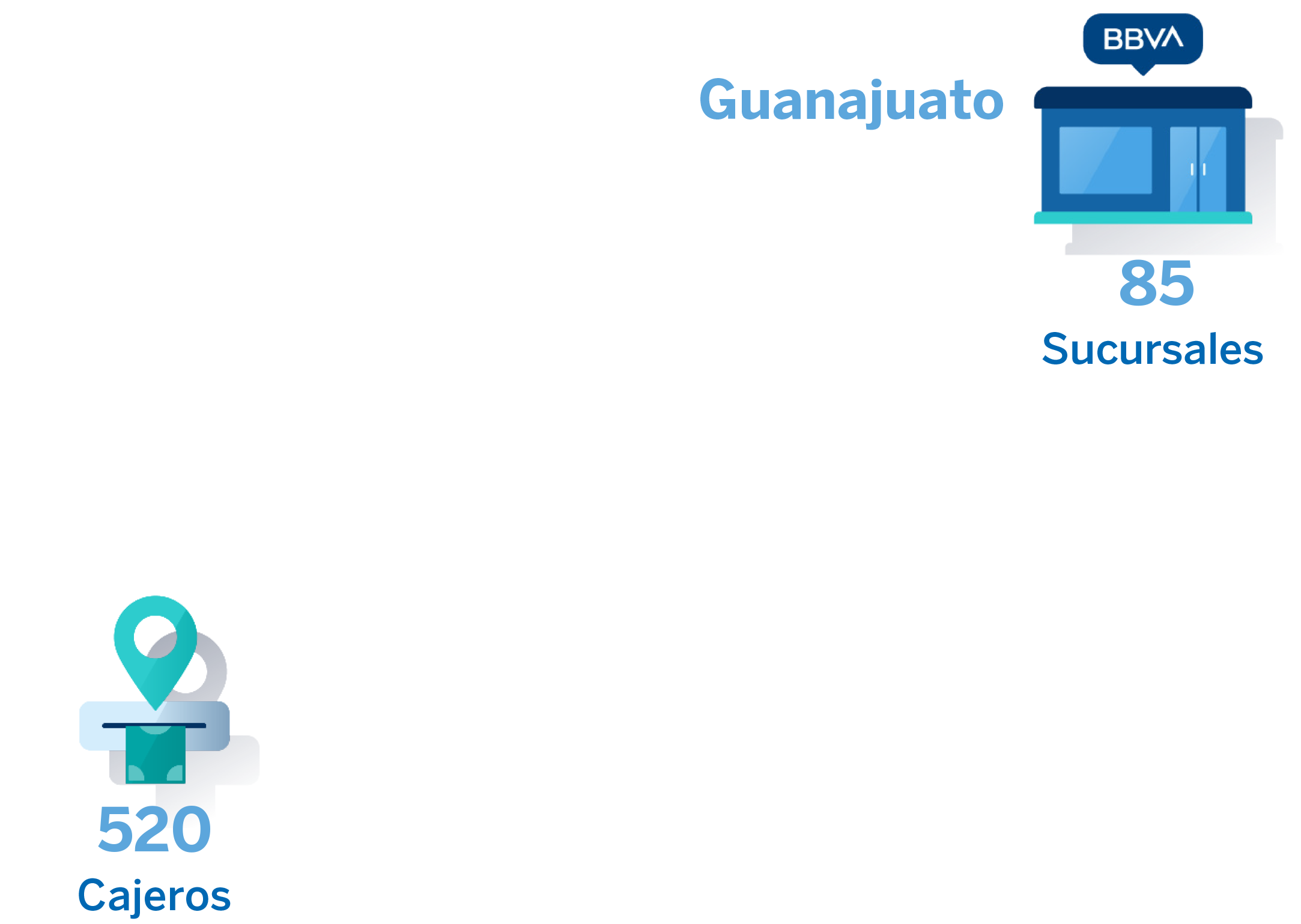

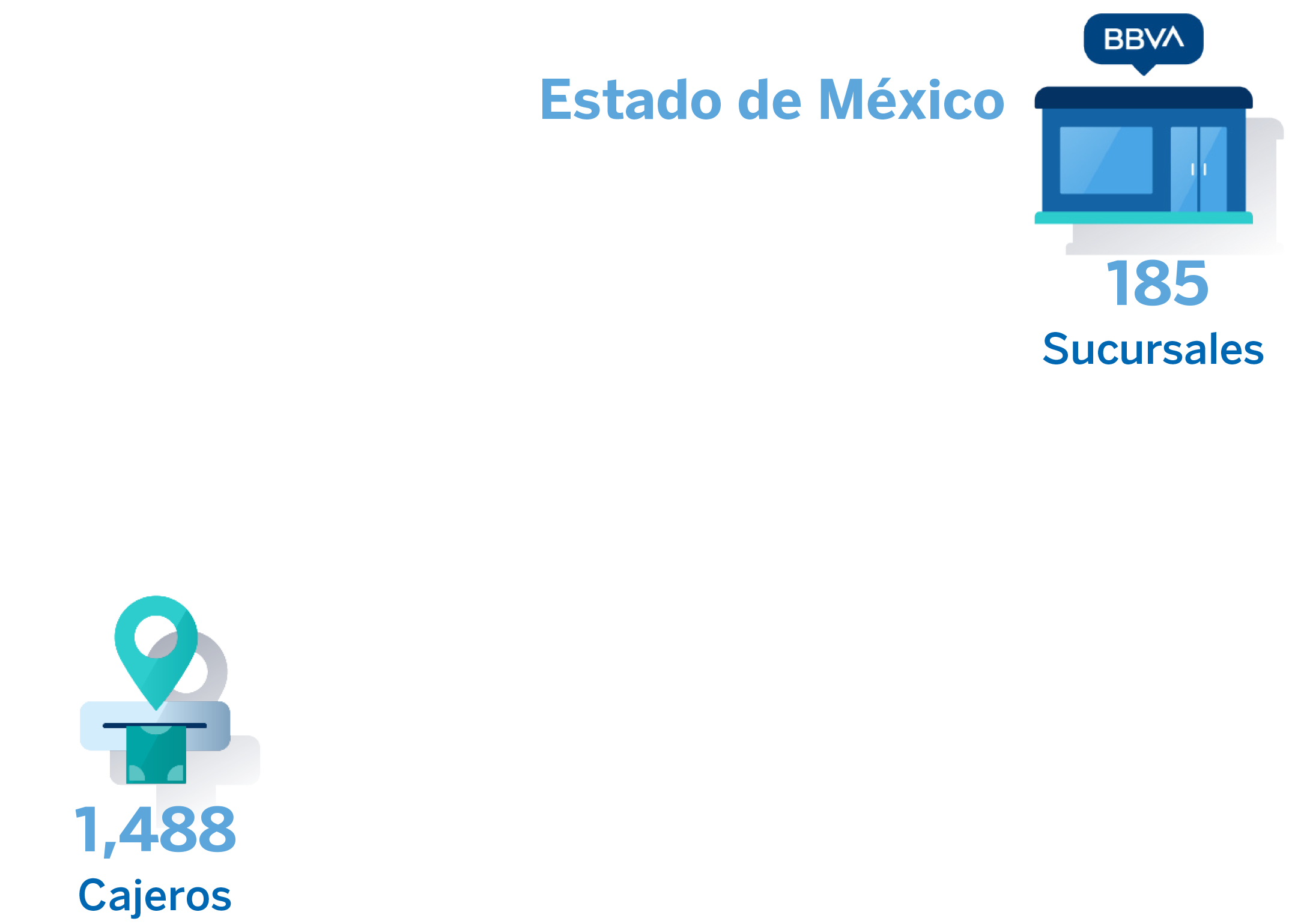

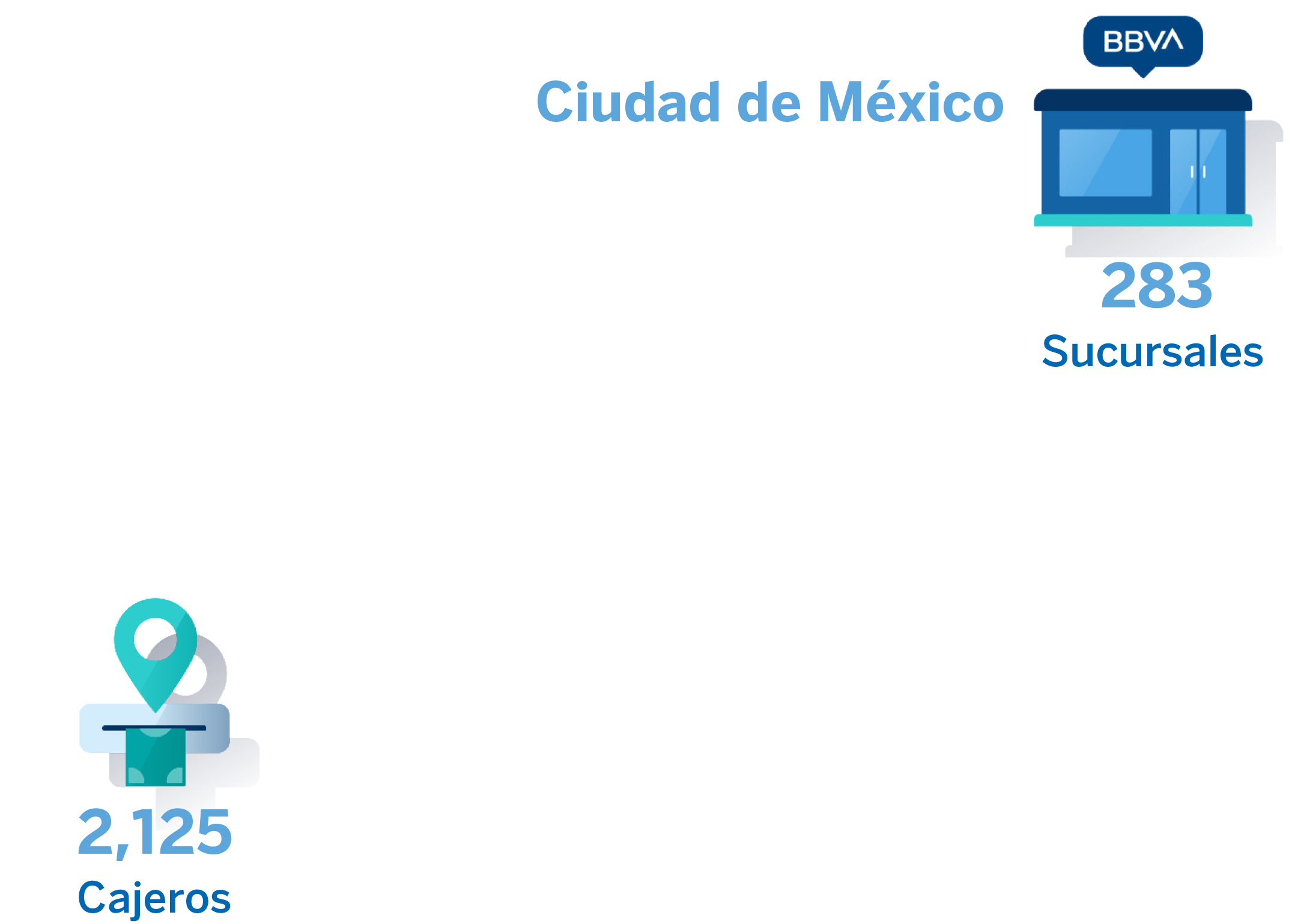

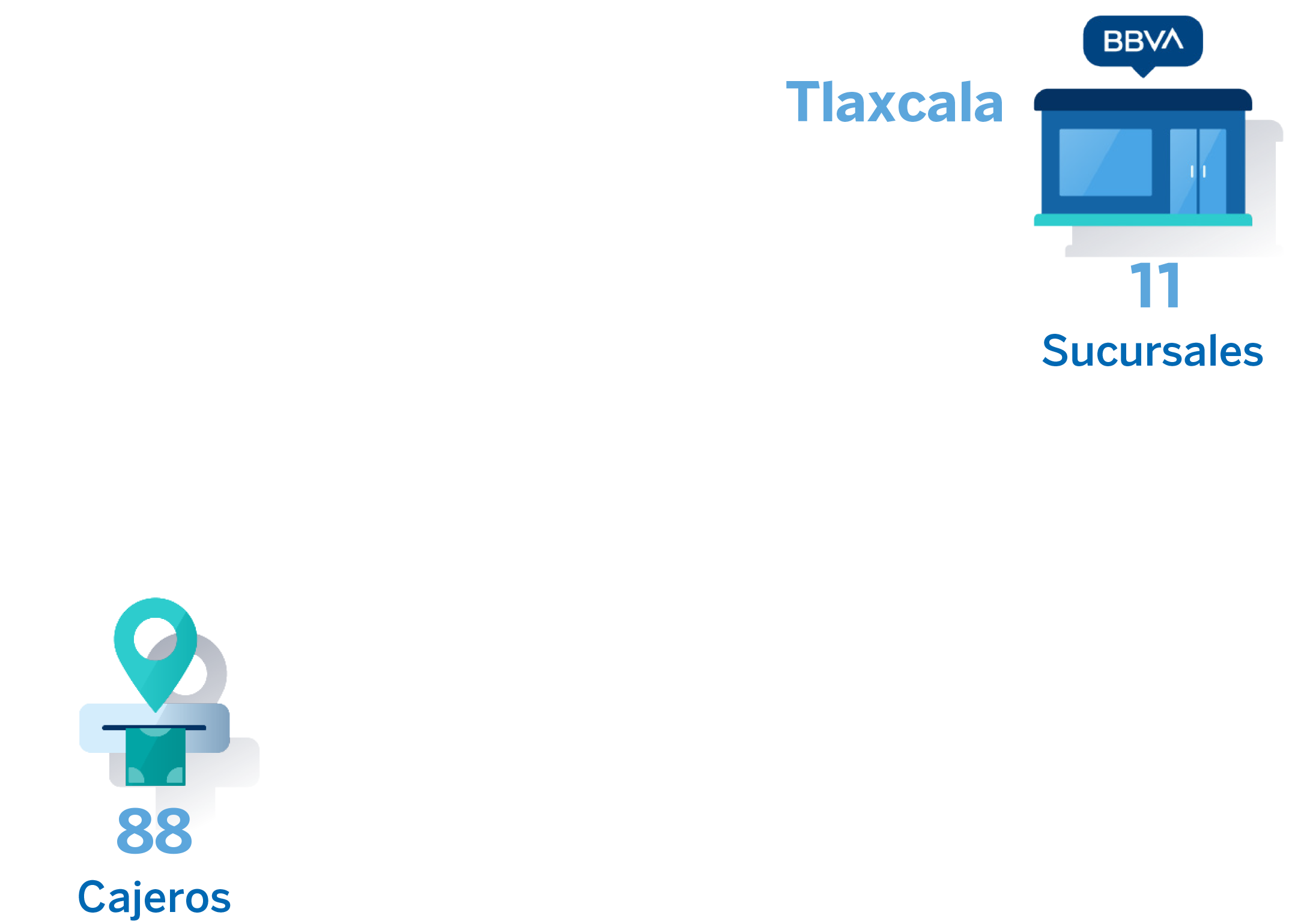

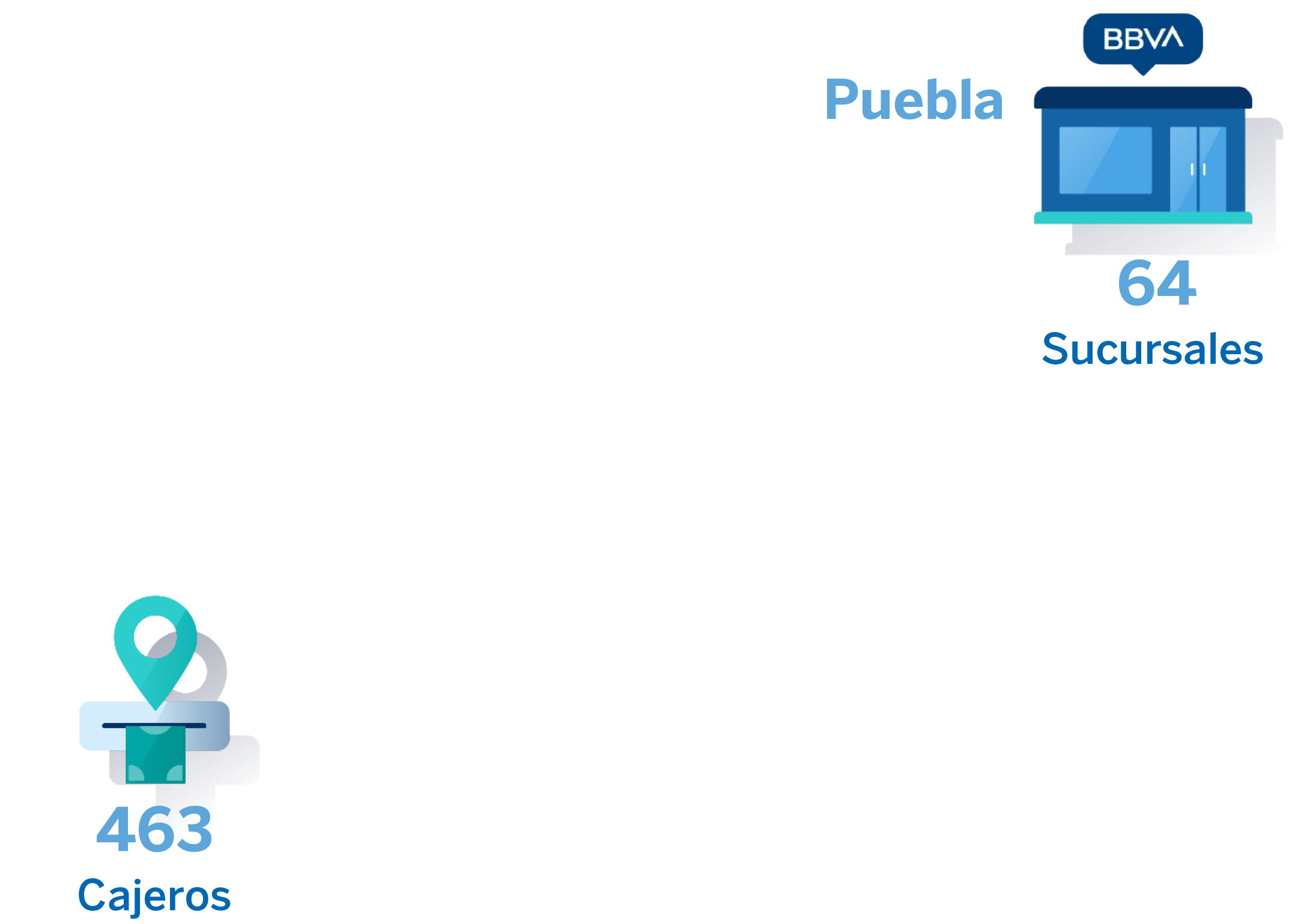

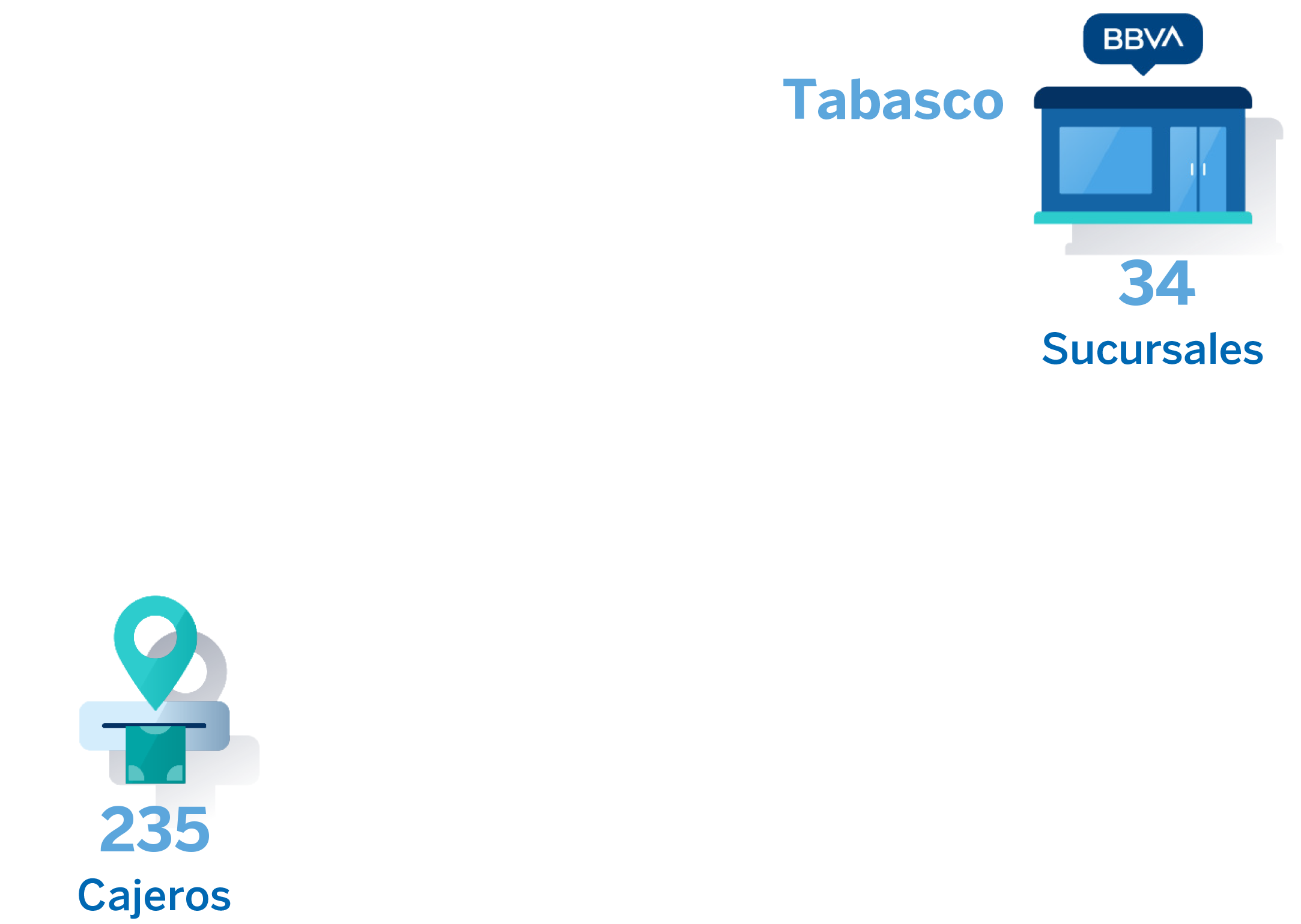

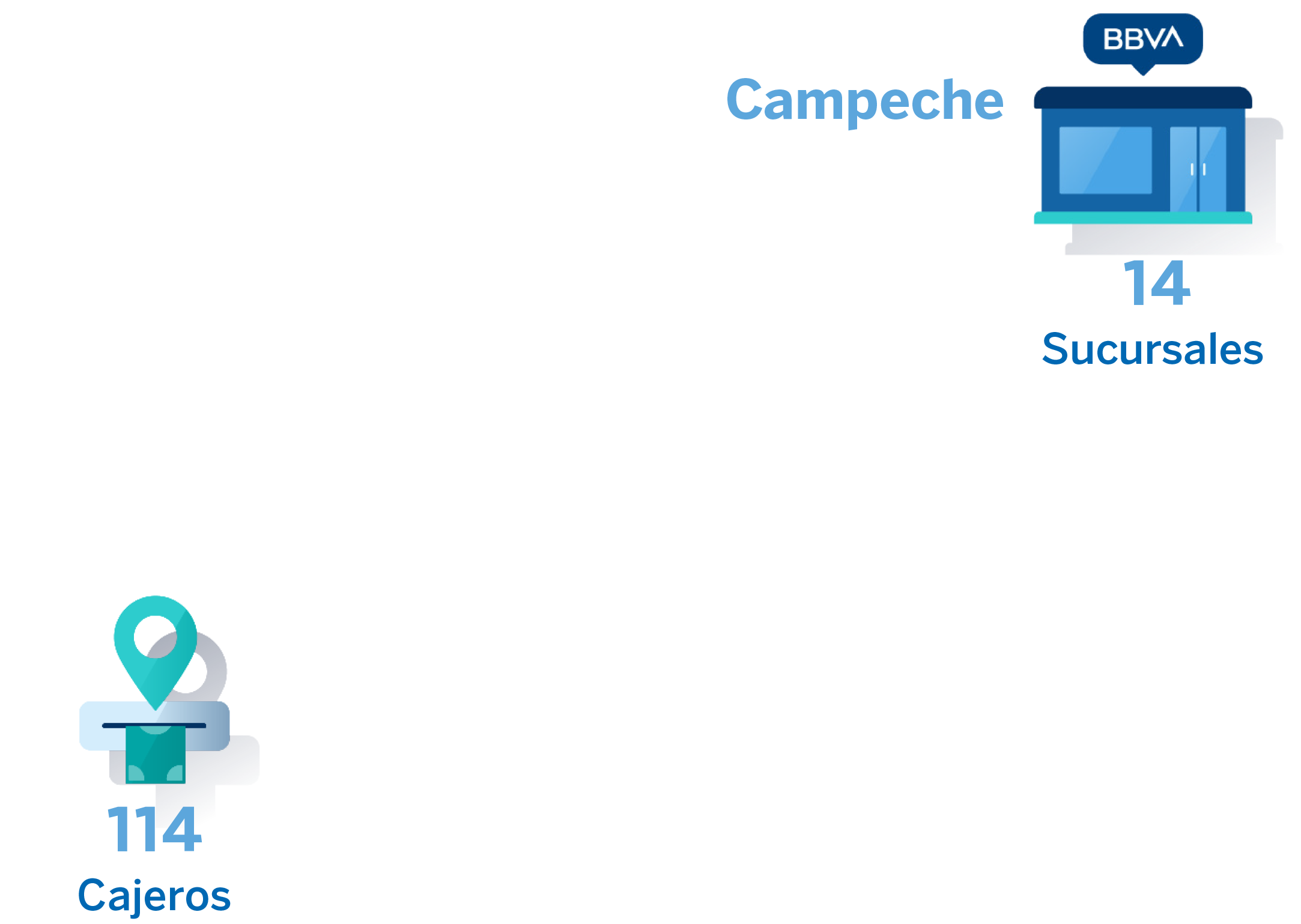

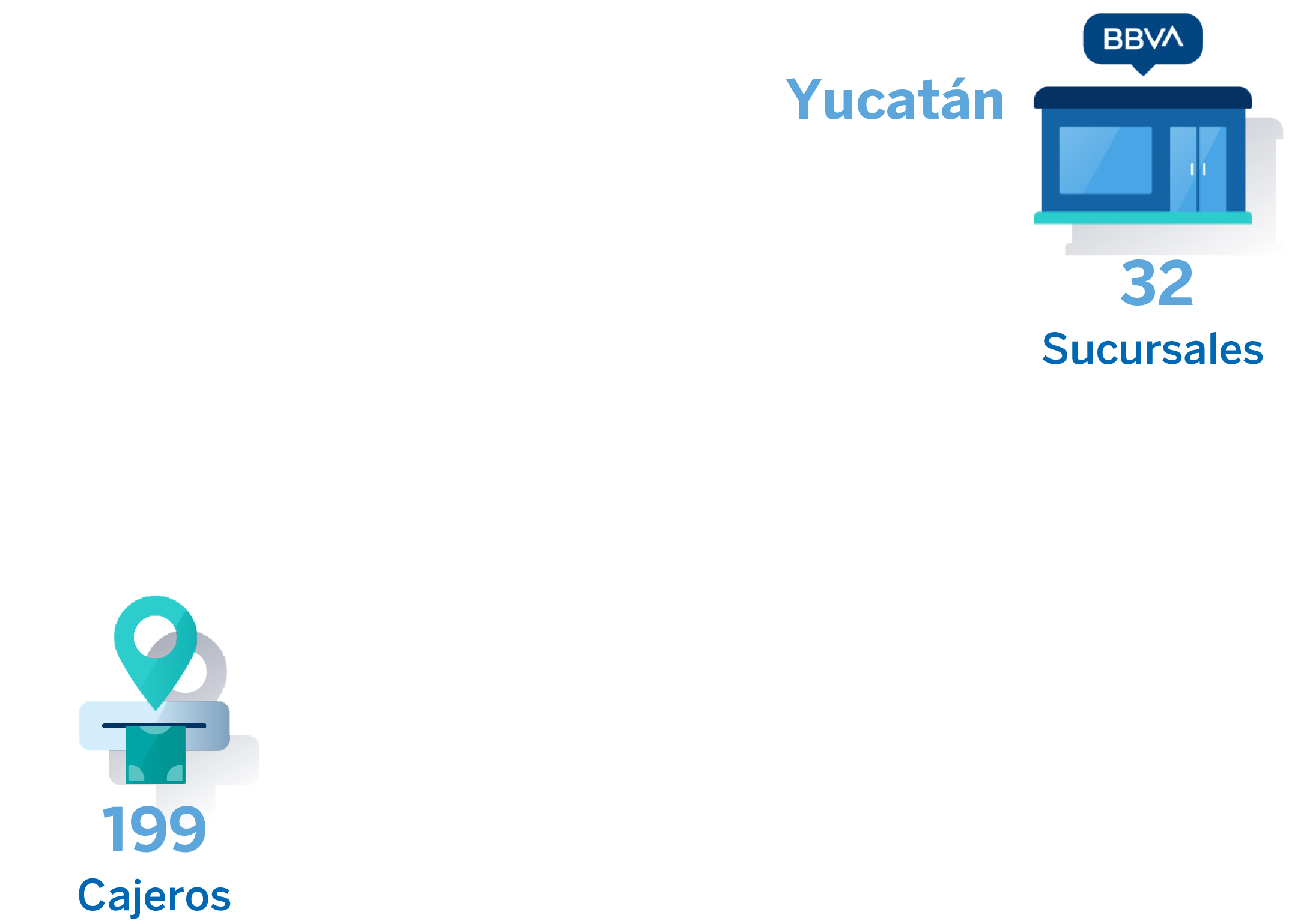

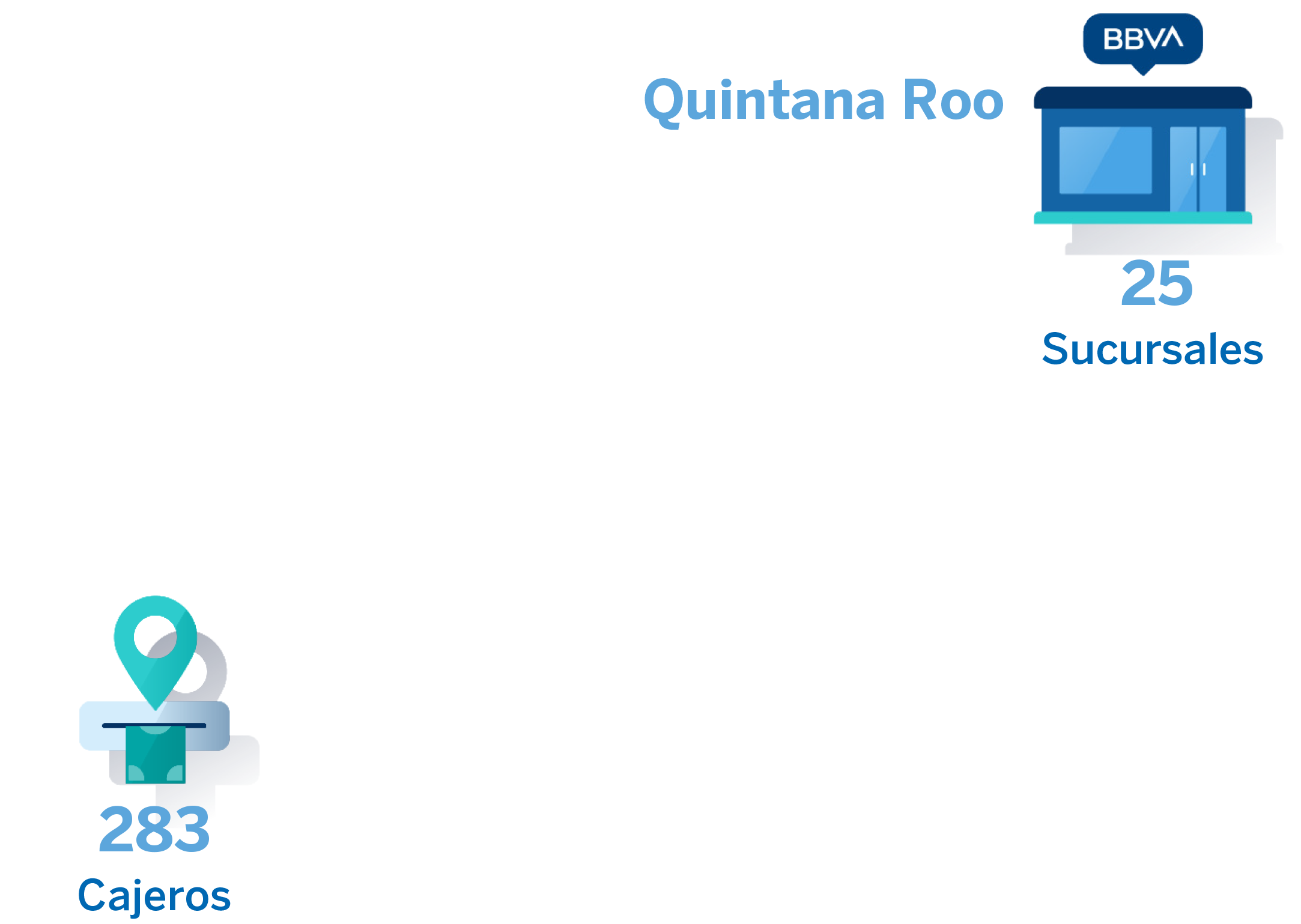

| States | Branches | ATMs |

|---|---|---|

| Aguascalientes | 21 | 173 |

| Baja California Norte | 58 | 419 |

| Baja California Sur | 21 | 137 |

| Campeche | 14 | 114 |

| Chiapas | 37 | 262 |

| Chihuahua | 61 | 455 |

| Mexico City | 283 | 2,125 |

| Coahuila | 41 | 380 |

| Colima | 13 | 81 |

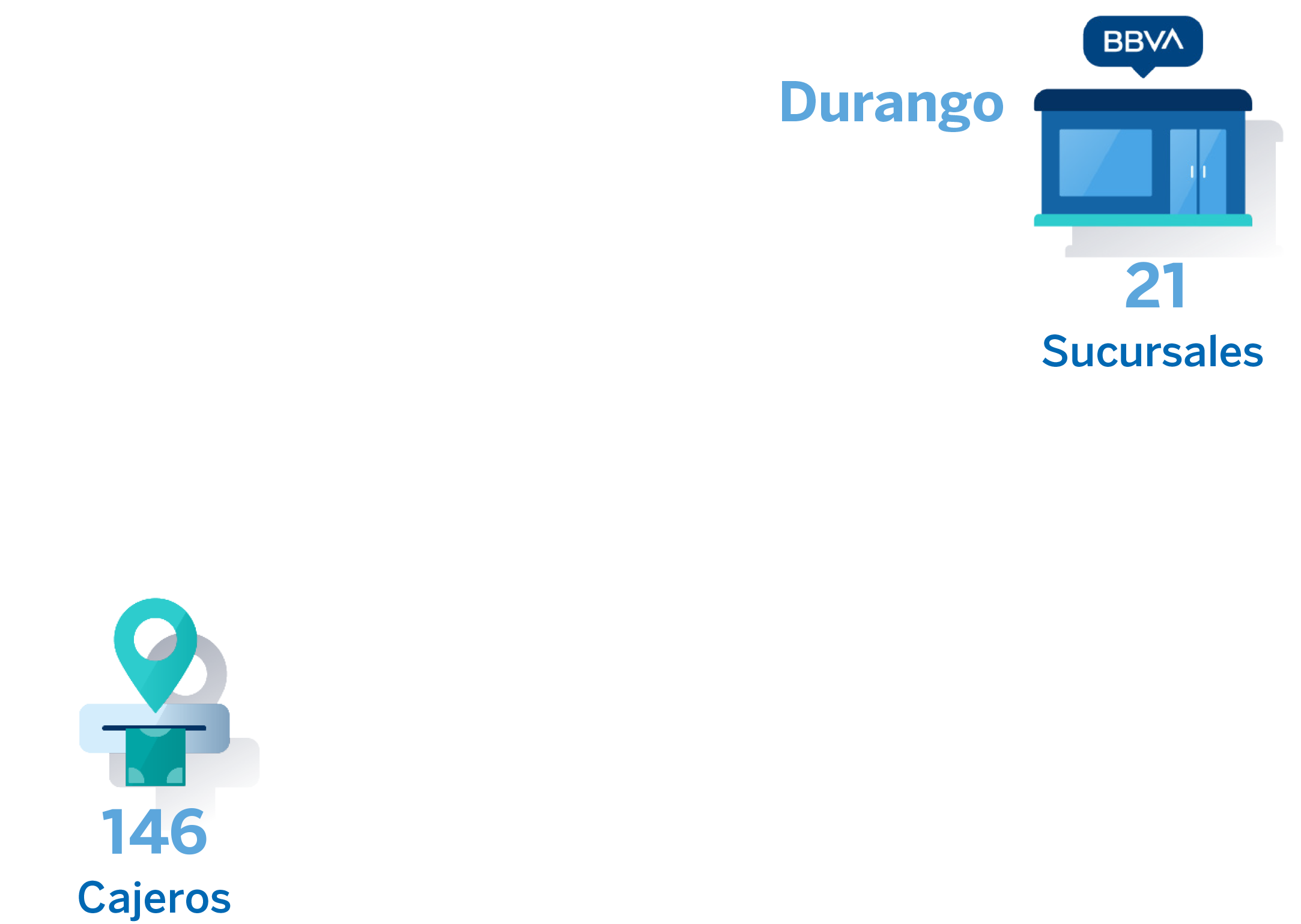

| Durango | 21 | 146 |

| State of Mexico | 185 | 1,488 |

| Guanajuato | 85 | 520 |

| Guerrero | 35 | 213 |

| Hidalgo | 34 | 258 |

| Jalisco | 195 | 1,148 |

| Michoacan | 88 | 505 |

| Morelos | 29 | 192 |

| Nayarit | 23 | 140 |

| Nuevo Leon | 109 | 697 |

| Oaxaca | 26 | 215 |

| Puebla | 64 | 463 |

| Queretaro | 34 | 269 |

| Quintana Roo | 25 | 283 |

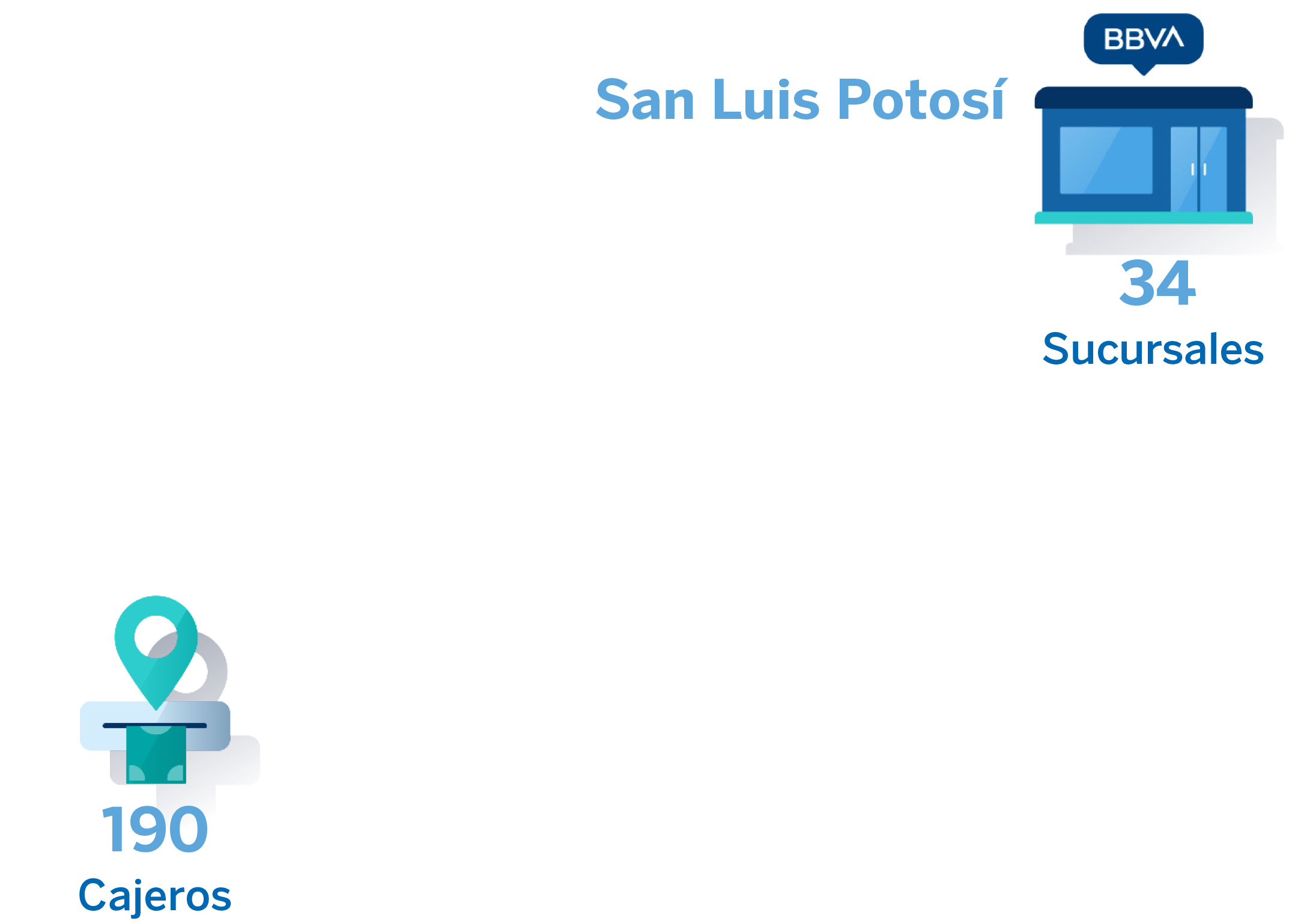

| San Luis Potosi | 34 | 190 |

| Sinaloa | 39 | 254 |

| Sonora | 53 | 398 |

| Tabasco | 34 | 235 |

| Tamaulipas | 48 | 349 |

| Tlaxcala | 11 | 88 |

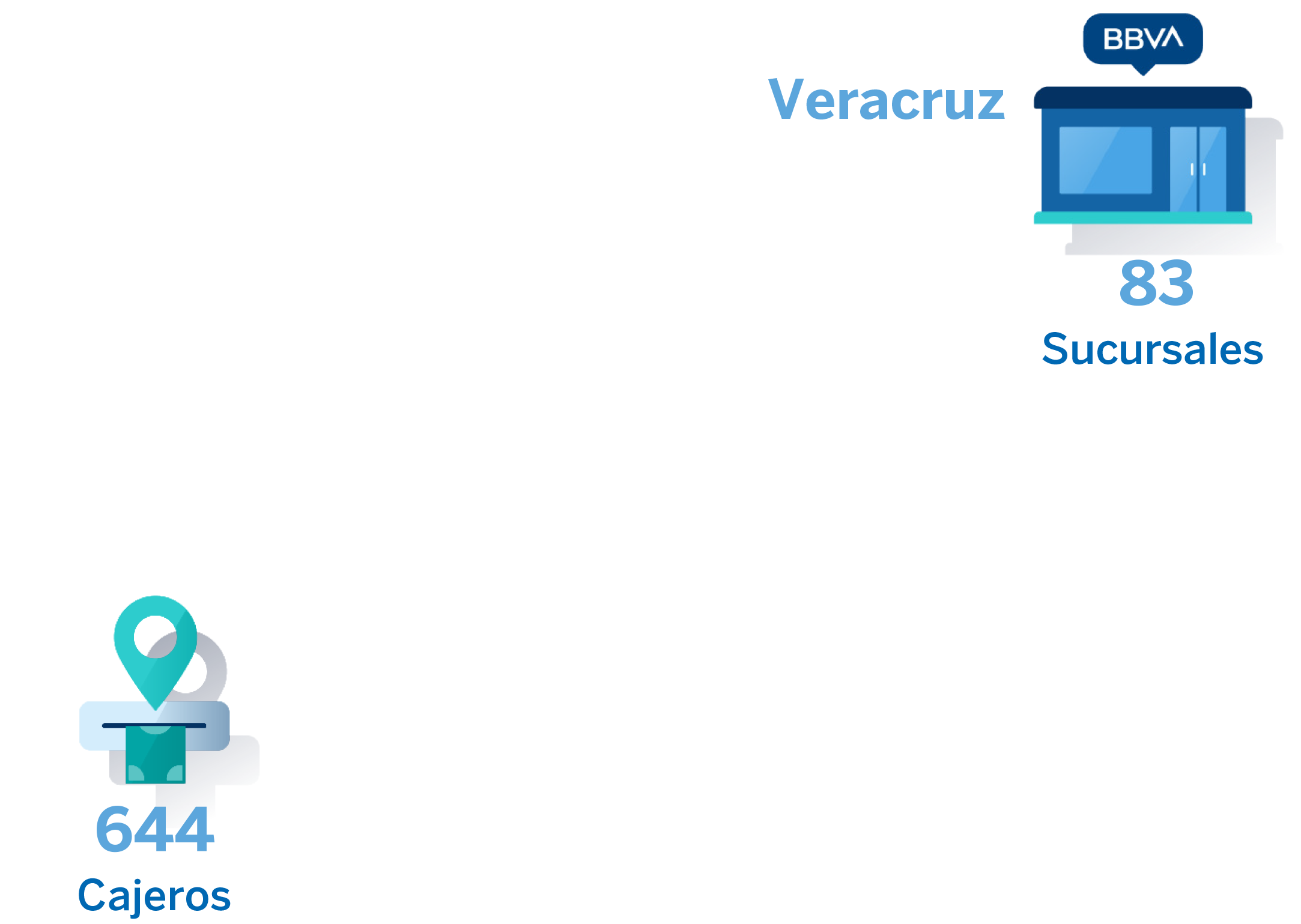

| Veracruz | 83 | 644 |

| Yucatan | 32 | 199 |

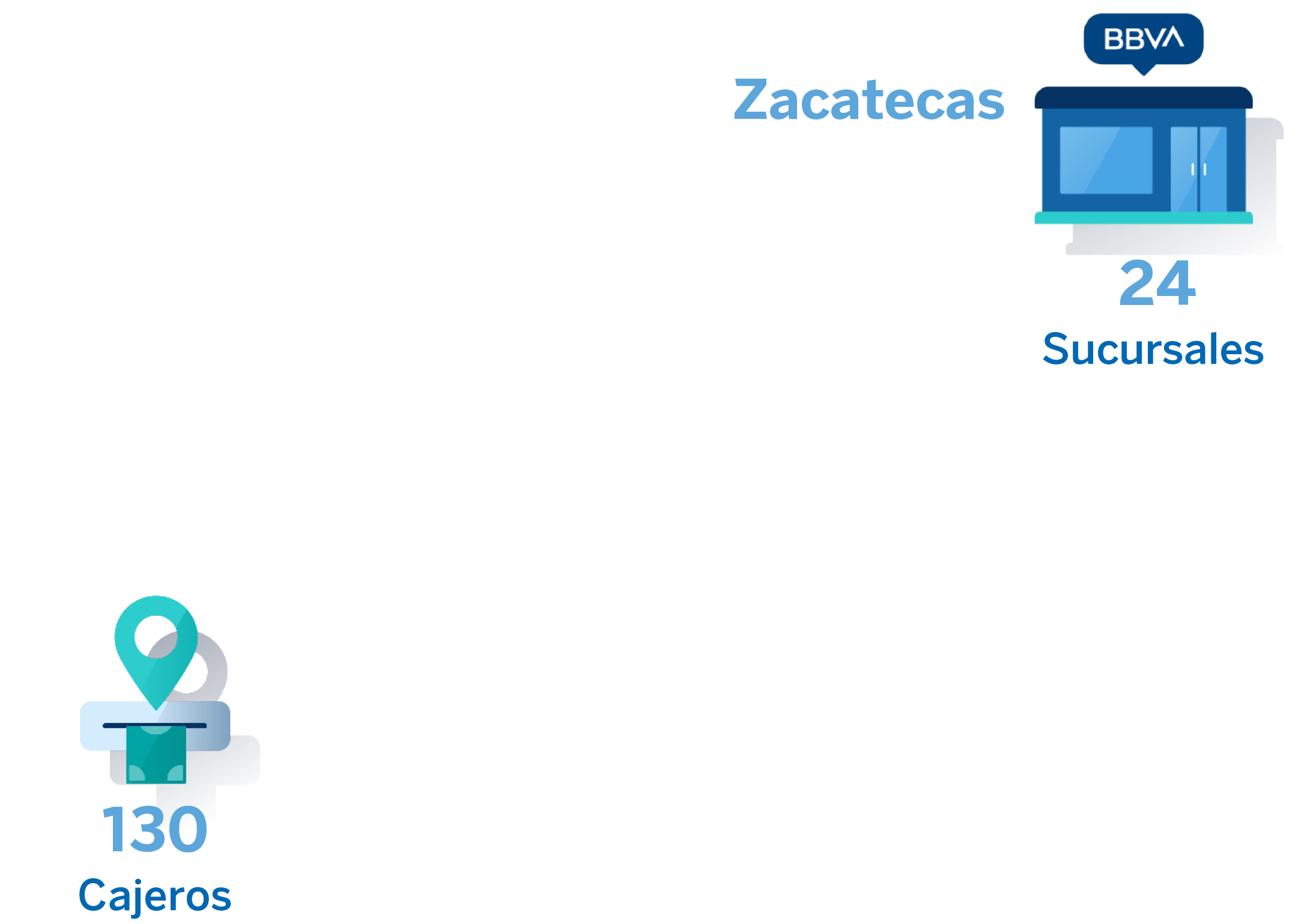

| Zacatecas | 24 | 130 |

Scope: BBVA Mexico Group.

Figures at December 2019.

Stakeholders and materiality analysis

Stakeholders

To identify its stakeholders, the BBVA Mexico Group performs analyses and monitoring based on the criteria established by the AA1000 Stakeholder Engagement Standard Guide. The Corporate Responsibility and Reputation division is responsible for generating a connection through channels of dialogue specific to each stakeholder.

Materiality

In 2017, the BBVA Mexico Group updated its methodology for the identification of relevant issues; since then, it has worked with the aim of accurately reporting the most important topics for its stakeholders.

Methodology

New methodology implemented and stakeholders identified to determine relevant topics were: employees, clients and the sector, based on public studies by recognized institutions and internal studies of the BBVA Mexico Group. The process identified 12 relevant topics.

The update of materiality followed this methodology:

|

Liaisons with suppliers and opinion leaders to identify relevant topics from both stakeholder groups; the results were added to the tool along with the Responsible Banking strategy and the materiality developed by the BBVA Group for the BBVA Mexico Group. The 12 previously identified relevant topics were updated. IA18 https://accionistaseinversores.bbva.com/wp-content/uploads/2019/05/BBVA_BANCOMER-IA2018_17042019-VF.pdf |

2017

New methodology implemented and stakeholders identified to determine relevant topics were: employees, clients and the sector, based on public studies by recognized institutions and internal studies of the BBVA Mexico Group. The process identified 12 relevant topics.

2018

Liaisons with suppliers and opinion leaders to identify relevant topics from both stakeholder groups; the results were added to the tool along with the Responsible Banking strategy and the materiality developed by the BBVA Group for the BBVA Mexico Group. The 12 previously identified relevant topics were updated.

2019

The update of materiality followed this methodology:

Top 15 relevant issues

|

BBVA 2019

relevant issues |

GRI standard

content |

|

|---|---|---|

|

Quality of customer care/service | N/A |

|

Corporate Governance | GRI 102-18 to 102-39 |

|

Risk management | GRI 102-18, 102-29 and 102-30 |

|

Communication and commercialization practices (including transparency) | GRI 417 |

|

Job quality | GRI 401 |

|

Social and environmentally responsible finance | FS7, FS8 and FS11 |

|

Environmental footprint | GRI 301, 302, 303, 305, 306 and 307 |

|

Products with good value for money | N/A |

|

Contribution to the development of local communities | GRI 413 |

|

Financial solvency and management | N/A |

|

Customer security, privacy and protection | GRI 418 |

|

Compliance system | GRI 205 |

|

Diversity | GRI 405 |

|

Talent attraction, development and retention | GRI 404 |

|

Digital transformation | N/A |