Profile and

Strategy

Grupo BBVA México is the largest bank in Mexico. One of the six strategic pillars of the Group is sustainability. BBVA’s sustainable development strategy is based on the Principles of Responsible Banking that are part of the United Nations Environment Programme Finance Initiative (UNEP FI). BBVA is committed to the Principles of the United Nations Global Compact and in 2016 made official its commitment to meet the objectives established at the Paris Summit and the United Nations Sustainable Development Goals (SDGs).

Group Profile

Grupo BBVA México has a presence throughout the Mexican Republic. It serves its clients through a wide network of branches and other distribution channels such as ATMs, bank correspondents, point of sale terminals, Internet, mobile applications, among others. Additionally, it has specialized executives who provide differentiated and personalized service to both private and business clients and government entities.

Grupo BBVA México remains the largest bank in Mexico1.

Our Aspiration

Strengthen the relationship with the client...

Helping our clients make the best financial decisions by providing relevant advice.

Providing the best solutions that generate trust: clear, simple, transparent and with fair conditions.

Through an easy and convenient experience: autonomously (DIY), through digital channels or human interaction.

Redefining our value proposal focused on the real needs of our clients.

Our Purpose

“Make available to everyone, the opportunities of this new era.”

Our Values

The Institution’s values are reflected in the day-to-day life of all employees of Grupo BBVA México, influencing all their decisions.

The client comes first

We are empathetic

We are of integrity

We solve your needs

We think big

We are ambitious

We break the mold

We surprise the client

We are a team

I am committed

I trust the other

I am BBVA

Presence

Source: Grupo BBVA México.

Figures as of December 2020.

|

State |

Branches |

ATMs |

|---|---|---|

|

Aguascalientes |

20 |

174 |

|

Baja California |

53 |

401 |

|

Baja California Sur |

20 |

139 |

|

Campeche |

14 |

110 |

|

Chiapas |

35 |

267 |

|

Chihuahua |

52 |

423 |

|

Mexico City |

267 |

2,090 |

|

Coahuila |

40 |

379 |

|

Colima |

11 |

76 |

|

Durango |

22 |

145 |

|

State of Mexico |

176 |

1,467 |

|

Guanajuato |

79 |

510 |

|

Guerrero |

31 |

186 |

|

Hidalgo |

32 |

262 |

|

Jalisco |

180 |

1,129 |

|

Michoacán |

85 |

527 |

|

Morelos |

28 |

183 |

Source: Grupo BBVA México.

Figures as of December 2020.

|

State |

Branches |

ATMs |

|---|---|---|

|

Nayarit |

22 |

140 |

|

Nuevo León |

106 |

663 |

|

Oaxaca |

25 |

202 |

|

Puebla |

60 |

464 |

|

Querétaro |

33 |

277 |

|

Quintana Roo |

22 |

270 |

|

San Luis Potosí |

31 |

188 |

|

Sinaloa |

36 |

228 |

|

Sonora |

50 |

411 |

|

Tabasco |

32 |

237 |

|

Tamaulipas |

42 |

351 |

|

Tlaxcala |

10 |

90 |

|

Veracruz |

75 |

618 |

|

Yucatán |

32 |

207 |

|

Zacatecas |

24 |

136 |

|

*Nacional |

1,745 |

12,950 |

Leadership

BBVA México

Infrastructure

14.4%

Branches

22.4%

ATMs

33.3%

POSs

Sources: CNBV, AMIB.

CNBV Information: Bank with SOFOM.

Information as of December 2020.

Commercial Activity

23.4%

Performing Loan

Portfolio

21.8%

Total

Assets

35.4%

Auto

loans

29.5%

Consumer +

Credit Cards

26.0%

Deposits on

demand

25.8%

Mortgage

loans

22.6%

Bank deposits

(demand + total term)

20.8%

Mutual

funds

29.3%

Government

loans

Strategic priorities

Based on the constant transformation of Grupo BBVA México to adapt to the major trends in the financial industry, such as the competitive environment, client behavior and expectations, the search for sustainability and data protection, it has developed three new blocks and six strategic priorities:

What defines us

Improve the financial health of our clients

Help our clients in the transition towards a sustainable future

Levers for differential performance

Grow in clients

Operational excellence

Accelerators to achieve our goals

The best and most committed team

Data and technology

Sustainability strategy

At a global level, BBVA has internalized the sustainable development strategy that today forms part of one of the strategic pillars:

Helping our clients towards the transition to a sustainable future.

BBVA’s sustainable development strategy is based on the Principles of Responsible Banking that are part of the United Nations Environment Programme Finance Initiative (UNEP FI). Thus, BBVA aligns its fundamental role of contributing to the economic development of the country with a comprehensive and equitable approach. The Principles provide the framework for a sustainable banking system and help the industry demonstrate how they make a positive contribution to society. The Responsible Banking model of Grupo BBVA México is applied to all business and support areas, with the aim of seeking a profitability adjusted to principles, strict compliance with the law, good practices and the creation of long-term value for all stakeholders.

Strategic Pillars of Responsible Banking of Grupo BBVA

Balanced relationships

Balanced relationships

with its clients, based on transparency, clarity and responsibility.

Responsible practices

Responsible practices

with collaborators, suppliers and other stakeholders.

Sustainable finance

Sustainable finance

to fight climate change, respect human rights and achieve the SDGs.

Investment in the community,

Investment in the community,

to promote social change and create opportunities for all.

During 2020, the Board of Directors of Banco Bilbao Vizcaya Argentaria, S.A. approved BBVA’s Sustainability Policy, which defines and establishes the general principles and management objectives in terms of sustainable development. Also, it seeks to promote the development of sustainable solutions and identify opportunities and offer advice for private clients and companies.

BBVA is committed to the Principles of the United Nations Global Compact and in 2016 made official its commitment to meet the objectives established at the Paris Summit and the United Nations Sustainable Development Goals. This has been demonstrated since 2018, when Commitment 2025 was presented, which aims to contribute to the achievement of the SDGs and the challenges arising from the Paris Climate Agreement.

Materiality

Since 2017, Grupo BBVA México updated its methodology for identifying material issues, with which it has worked over the last three years with the aim of accurately reporting the most important issues for its stakeholders.

2017

Methodology

The new methodology was implemented and the stakeholders to consider to determine the material issues were: employees, clients and the sector based on public studies of recognized institutions and internal studies of Grupo BBVA México. 15 material topic were identified.

17AR: https://investors.bbva.mx/wp-content/uploads/2019/03/informe-anual-2017.pdf

2018

An approach was carried out with suppliers and opinion leaders to identify relevant issues of both stakeholders. The results were added to the tool together with the Responsible Banking strategy and the materiality developed by Grupo BBVA for Grupo BBVA México. The 12 previously identified material topics were updated.

2019

Materiality was updated in accordance with the methodology implemented in 2017, integrating key issues from BBVA’s strategy. The SDGs relevant to BBVA and in which it can generate the greatest impact were identified.

2020

The materiality update was carried out using the following methodology:

Validation and review of the material issues reported in 2019.

Updating of previously used internal studies with the most recent results.

Analysis of studies focused on relevant issues in the sector of institutions such as the World Economic Forum, Carbon Disclosure Project (CDP), 2020 SAM sectoral materiality, SASB sectoral materiality, material issues of domestic financial institutions, among others.

Collection, validation and integration of information to the materiality tool for its 2020 update.

As a result of this exercise, 15 material topics were identified:

|

BBVA 2020 Material Topics |

GRI Standard Content |

|---|---|

Communication and

|

GRI 417 |

Corporate Governance |

GRI 102-18 to 102-39 |

Socially and environmentally

|

FS7, FS8 and FS11 |

Compliance system |

GRI 205, 307 |

Environmental footprint |

GRI 301, 302, 303, 305, 306 and 307 |

Ethical behavior |

GRI 206, 102-16, 102-17 |

Contribution to society |

GRI 413 |

Financial education and inclusion |

FS13, FS14 |

Cybersecurity and responsible

|

GRI 418 |

Employment |

GRI 401 |

Anti-Money Laundering/Terrorism |

GRI 205 |

Risk and crisis management |

GRI 102-18, 102-29 and 102-30 |

Anti-corruption |

GRI 205 |

Diversity |

GRI 405 |

Talent attraction, development and retention |

GRI 404 |

Stakeholders

To identify its stakeholders, Grupo BBVA México has an analysis and monitoring based on the criteria established by the AA1000 Stakeholder Engagement Standard Guide2. The Corporate Responsibility and Reputation area is who is committed to generating a relationship through the following specific dialogue channels for each stakeholder:

Shareholders

Clients

Employees

Suppliers

Regulators

Society

2 For more information on the AA1000 Guide, visit: https://www.accountability.org/standards/.

Global Compact and Sustainable Development Goals (SDG)

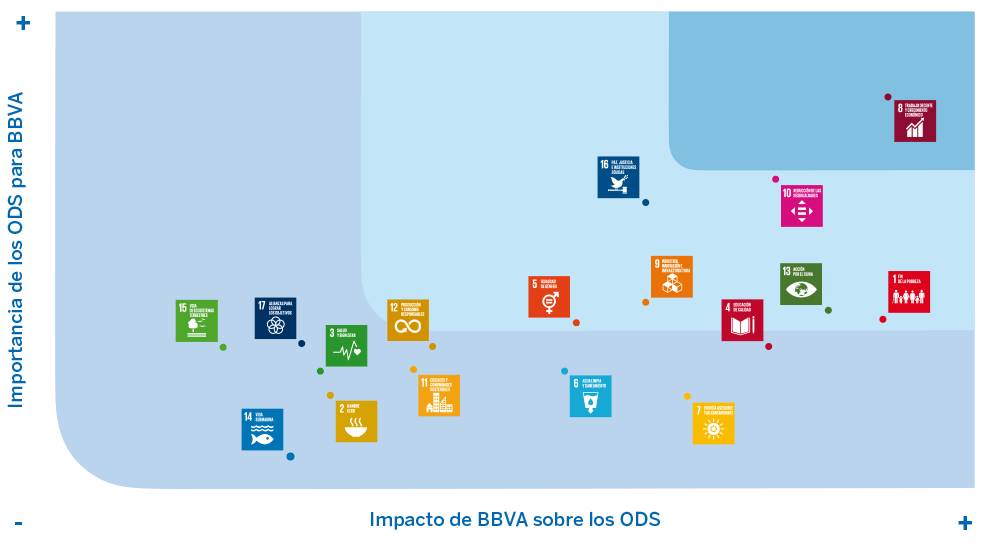

In 2018, the Grupo BBVA announced its climate change and sustainable development strategy, in order to contribute to the SDGs and the Paris Agreement. This strategy focuses on mobilizing capital aimed at curbing climate change and contributing to the specific goals of the SDGs. To mitigate and eradicate the different problems presented in each SDG and based on the materiality study carried out in 2020, Grupo BBVA México has identified the most important SDGs for the Institution along with their level of contribution to achieve its goals. The graph shown below corresponds to the level of contribution of Grupo BBVA México to the specific goals for the fulfillment of each SDG:

The SDGs were established to meet humanity’s universal challenges, protect the environment, and solve socio-economic problems. The SDGs are made up of 17 objectives and 169 specific goals that international society must meet by 2030.

To learn more, visit the official page: https://www.un.org/sustainabledevelopment/es/objetivos-de-desarrollo-sostenible/.

Business model

Grupo BBVA México is a bank in constant transformation, evolving every day to improve the client experience, offering traditional products and innovating through its digital product offer.

One of the main elements of the business model is client segmentation, which allows specialized attention to be provided through each of the Business Units, dedicated to the development of products and services focused on client needs.

Grupo BBVA México’s business model allows it to create opportunities and consolidate its leadership in the country.

Business Units

Retail Network

Retail Network’s business unit manages the entire branch network, offering services to a variety of individual client segments, ranging from high net worth, private, wealth and personal to banking and express; micro and small businesses (SMEs) are also catered for.

323,642 new payrolls in 2020; 92% of the persons who changed their payroll to Grupo BBVA México did so through our digital channels.

Business and Government Banking

We offer services to the Government and Businesses Banking segment through a network of 132 branches. Clients in this segment are also an important source of deposits, since they mainly use savings and cash management products. We offer a wide range of products designed to meet client requirements for collections and cash management solutions, together with services to increase cross-selling opportunities and customer loyalty.

Home Developers. This segment provides loans to developers for construction purposes.

Consumer Finance. This unit was created exclusively to satisfy the diverse requirements of the automotive industry, including loans for the distribution and acquisition of vehicles. Additionally, this unit is part of the Corporate and Investment Banking segment, as it provides services to meet the financial needs of car dealers.

Governmental Entities. This segment has 28 specialized branches and personalized services to meet the needs of the Mexican federal government, the states and municipalities of Mexico, and other government agencies. The wide range of products for this segment includes paycheck services for government employees and checking accounts and tax collection services for states and municipalities. We also offer products such as “Multipagos” and “CIE Online” for tax collection.

Corporate and Investment Banking

We offer credit products and services to corporate and institutional clients, mergers and acquisitions services, market trading (equity and fixed income), cash management, online banking and investment products. In this segment, we have a client base close to 588 multinationals located in Mexico and institutional clients. The segment strives to ensure that clients receive the best possible service by developing new products tailored to their needs.

Corporate and Investment Banking also includes our global markets unit and, in association with the Broker-Dealer, we offer more sophisticated products and services to both individuals and companies, such as debt and equity placements and issuances, and structured financing. The Bank has led the SHCP and Banco de México ranking of Market Makers since 2012. As market makers, we play an active role in the fixed-rate government securities market and primary auction bids for these securities.

Economic impact

Evolution of the activity

Total Performing Loan Portfolio

(MXP billion)

In 2020, at Grupo BBVA México we were able to consolidate our leadership position in the performing loan portfolio with an increase in market share of 34 bps to closing the month of December with 23.4% a share, according to figures from the CNBV.

Mortgages stand out and continue to show a solid performance with a balance 7.7% higher than in 2019.

Mortgage Loan Portfolio

(MXP billion)

Increase in bank deposits3 of 12.8% in annual terms.

Bank deposits

(demand + total time)

(MXP billion)

3 Bank deposits = demand + total term + global deposit account without transactions.

Grupo BBVA México consolidates its leadership position by registering a 22.6% market share in bank deposits.

Assets managed in investment funds closed in December 2020 at MXP 497,638 million, which means an annual increase of 6.6%. As such, the Investment Fund Manager has positioned itself as the largest investment fund manager in the market with a stake of 20.8%, based on information from the CNBV as of December 2020.

MXP 497,638 million in assets managed in mutual funds, resulting in a 20.8% market share and a 6.6% increase compared to the previous year.

Evolution of the results

At the end of the year, we have generated a net income of MXP 42,860 million, equal to a decrease of 24.8% compared to 2019. This is mainly explained by lower income related to the application of support programs and the creation of additional reserves to cover a potential impairment of the portfolio, partially offset by our strategy of maintaining tight control over spending to mitigate the impact of lower revenues.

The financial margin in the year shows a decline of 1.1% with respect to the previous year, explained by a change in the portfolio mix with greater weight towards the wholesale segments; the 300 bps reduction in the reference rate in the last twelve months and, finally, the implementation of the customer support program.

Net Income

(MXP millions)

Relevant information

|

Indicators (%) |

GFBB |

Market* |

|---|---|---|

|

Return on capital (ROE) |

16.8 |

11.3 |

|

Net Interest Margin (NIM) |

5.3 |

5.0 |

|

Efficiency Ratio |

38.1 |

46.9 |

|

Past Due Loan Ratio |

3.0 |

2.6 |

*Financial Groups Market includes: BBVA, Banorte, Inbursa, HSBC, Scotiabank, Santander and Citibanamex