BBVA Mexico reported its year-end 2024 results, highlighting that the total loan portfolio grew by more than MXN 262 billion compared to the previous year, closing at nearly MXN 2 trillion—equivalent to an annual growth of 15.8%. This increase was driven by the positive performance across all portfolio segments, particularly those linked to households, as well as the business and corporate segments.

According to the financial institution, the total performance of the loan portfolio in 2024 in the household segment (credit cards, consumer loans, auto loans, and mortgages) reached a balance of MXN 845 billion, representing a 12.7% increase compared to the same period of the previous year.

In the SME segment, the portfolio reached a balance of MXN 136 billion, showing strong growth of 21.4%. The corporate loan portfolio (including corporate, promoter, and financial entities) closed 2024 with a balance of MXN 721 billion up 21.5% year-over-year. Meanwhile, the government portfolio grew by 6.6%, totaling MXN 204 billion.

In the credit card segment, more than 2.5 million new cards were issued by year-end, including 540,000 first-time cardholders. In the consumer loan segment, 2.7 million new loans were granted.

During the same period, 34,400 new mortgage loans were issued for home purchases, reaching a total of 352,000 financed mortgages. In the auto loan segment, 156,000 new loans were originated, bringing the total to 402,000 active auto loans.

Based on this origination activity, BBVA Mexico granted a total of 5.4 million new loans to households by the end of 2024, reaching a total of 11.3 million individual borrowers.

In line with the Plan México introduced by the federal government, BBVA Mexico reaffirmed its position as the bank for SMEs. In 2024, new loan origination in this segment totaled MXN 241 billion, a 16% increase compared to December 2023. Of this amount, 7% was granted to SMEs with no previous banking history. As of December 2024, the total SME portfolio stood at MXN 136 billion.

Through its Banco de Barrio initiative, the institution continued to strengthen the micro, small, and medium-sized enterprise segment. As of year-end 2024, the program reported 110,000 new clients, bringing the total to 402,000. Since 2020, over 286,000 new point-of-sale (POS) terminals have been deployed, and more than 1.1 million payroll accounts have been opened.

The financial institution also collaborated with all three levels of government to support productive projects. Loan origination in this category totaled MXN 29 billion in 2024, up 20% from the previous year. From January to December, more than MXN 73.96 billion were mobilized in inclusive growth initiatives.

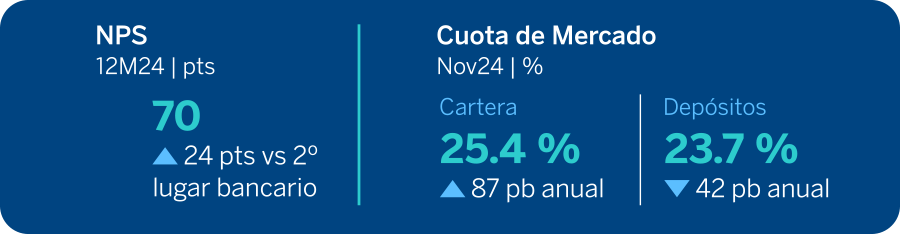

Demand and savings deposits reached a balance of MXN 1.5 trillion, reflecting a 7.1% increase. Time deposits reported a balance of MXN 281 billion, representing growth of 8.2%. Investment funds totaled MXN 1.03 trillion, marking a 25.6% increase compared to the previous year. As a result, total client resources held by the bank amounted to MXN 2.8 trillion, up 13.1% versus 2023.

BBVA México maintains a robust framework for credit approval, monitoring, and risk management, which is reflected in its credit quality indicators. The non-performing loan ratio (NPL) stood at 1.6% as of December year-end, comparing favorably to the most recent publicly available system-wide NPL figure of 2.0% as of November 2024 (according to data published by the National Banking and Securities Commission). The Stage 3 loan coverage ratio as of December 2024 reached 193.1%.